In the fast-moving world of digital assets, operational effectiveness is not merely an advantage, it's a must. For companies that use the TRON network and need USDT on a regular basis - from payment gateways and trading platforms to e-commerce websites and dApps - cost management is an important part of competitiveness. Although between the high speed and low fees available for moving stablecoins on the TRON blockchain it is hard to beat, the payment of a transaction can make a world of difference on a company's profit margins.

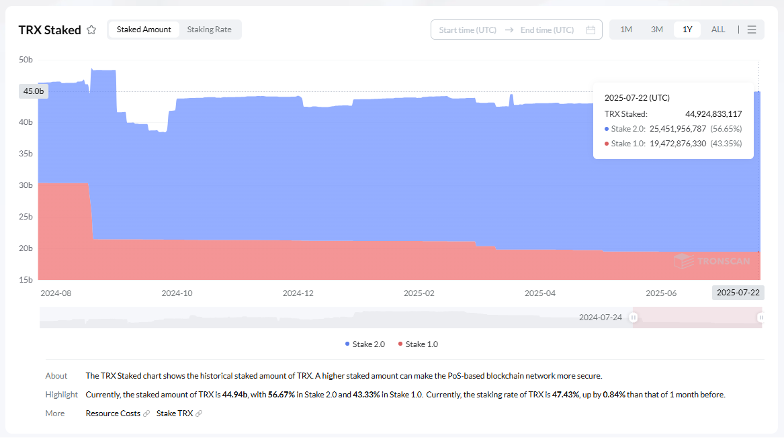

Most businesses opt to use their own TRX tokens in order to "stake" (put up temporarily) the amount you need to access this "Energy". But let us tell you: there is a much better solution when you look at the figures - borrowing Energy from certain specialized services. This article is going to dive deep into insider data on the comparison of TRON transaction payment techniques, and illustrate why Tron energy rental becomes the better choice for businesses' cost-efficiency and liquidity assurance to scale up their business power.

Breaking Down the Cost of Transactions on the TRON Network

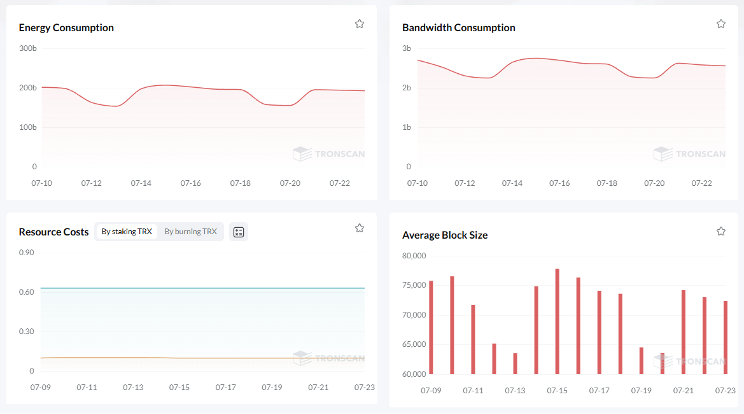

Each operation on the TRON network, such as a token transfer or smart contract run, needs two general resources - Bandwidth and Energy. While both are important, they are for different reasons, and knowing the difference is very important for cost control.

Bandwidth. This is used by every transaction and it's mainly used for transmission of the transaction data to the network. Think of it as the 'space' transaction take up on the blockchain. Each account on the TRON network has a free daily limit for Bandwidth of 600 points. This is just enough for some basic TRX transfers, but it quickly runs out for more advanced usage, such as smart contracts. After the free allowance is consumed, you need to acquire Bandwidth through freezing TRX or burning a tiny bit of TRX for each transaction.

Energy. The computational power of the TRON network. It is only burned when a transaction is "touched" by a smart contract. As the widely-known TRON-based USDT is a TRC-20 token issued and run on a smart contract, all Tether transactions rely on a substantial quantity of Energy. Energy has no free daily allocation (unlike Bandwidth), and how to manage it becomes the main problem for any business using USDT.

Energy - How to Get It?

The Energy demand of a conventional USDT transfer is paramount for any company:

- 65,000 Energy: when transferred to a recipient which is a wallet that already has some USDT. And if there is no Energy in an account, the network burns about +13.4 TRX to take care of it.

- 131,000 Energy: for transferring to a "new" or "empty" wallet, meaning one that has no USDT. This first send (i.e. initial send) is also an activate - so it will demand extra resources in the future.

And to address these inevitable Energy expenses, companies essentially have three potential ways of going about it - with significantly different financial implications:

Burning TRX (default method). If there isn't enough Energy staked on an account, the network will automatically burn the equivalent amount of TRX held by the sender of the transaction in order to perform the requested operation. By far the most costly and highly inefficient route, is similar to paying top dollar for every single transaction.

Staking TRX (capital intensive way). People enticed to for whatever reason decide to "lock" their TRX tokens for at least 14 days. In exchange their account gains a fixed amount of Energy over time. This does remove the per transaction cost, but also ties up large amounts of capital.

Renting Energy (special option). Tron energy renting services where the user spends a modest fee to get a largespread of Energy delegated to their account for a duration. This lets them pool transactions, all without running out of capital to deploy.

Staking Predicament: Deeper Look at the Benefits and the Cost

On the surface, staking TRX reads as a sensible, one-off transaction to ensure a limitless supply of Energy in the future. I feel like it's an investment that will pay for itself. But it is rather easy argument because it does not take into account the opportunity costs and the uncertainties involved, and it is hardly a real choice for an agile, active business.

Let's build our real-time situation even more. For a business to even be able to do one 65,000-Energy USDT transfer a day, it would need to stake up to 12,000 TRX. And, while it is no doubt a strong top-10 cryptocurrency, stashing a huge amount of capital away has its own set of inherent drawbacks, which go beyond just the numbers.

Opportunity Cost of Marginal Capital in Investment

This, however, is where the math gets interesting for any CFO or operations manager. Instead of holding the capital of those 12,000 TRX, a business could instead opt to rent energy on the Tron blockchain as and when they require it. Here's a direct comparison:

Staking 12,000 TRX will freeze, enabling a limited amount of daily Energy. This would serve approximately 440 standard USDT transactions, before the staked TRX cost is paid off with renting. And during that period, the 12,000 TRX is entirely illiquid, unable to be utilized for any other purpose.

Renting the same capital (market price of 12,000 TRX) for a rented Energy, a business could issue around 1,400 transactions.

The difference is stark. Renting Energy holds over 3 times as much transactional capacity for the same value of capital. For a business with dozens or hundreds of payments per day, those charges can add up to huge direct savings. But more significantly still, it allows precious TRX to remain liquid, free to be deployed for other strategic financial ventures that is market making, yield farming, or just responding to the markets.

Market Volatility and Risk

And the 14-days to unfreeze staked TRX is a fairly significant market risk. The company couldn't sell its assets if the price of TRX fall off a cliff. Staked capital is always "at risk" due to market movements and without any of the control a trader would need to manage risk. Tron energy rental allows you to remove this kind of risk completely from the equation as it completely separates the requirement for Energy from the need to keep a large long position on TRX.

It's worth noting, GasFree services provided by certain wallets/platforms as well. These products, however, automatically pay transaction fees on behalf of the user, and give the impression that transactions are free or easy. But that convenience has a high, and often buried, cost. For each transaction, the cost is usually significantly higher than that of burning TRX and renting Tron power It's the worst deal in town for any serious business, in other words.

Clear Business Victor: Strategic Benefits of Renting Energy as a Service

For any business that makes a lot of regular USDT transfers, the advantages of utilising a specialist USDT rental service are there for all to see beyond simple cost savings. It's simply a more strategic way of running your on-chain operations.

Maximized Cost Efficiency. This is the obvious gain. It was always cheaper just to rent as opposed to stake and burn. Companies can save as much as 80% of their transaction-related costs and the savings are all bottom line profit, assuming there is a positive margin on every transaction.

Increased Capital Liquidity and Financial Flexibility. In a fluid, ever-evolving marketplace of crypto, liquidity is lord. Rather than locking up thousands or even millions of dollars worth of TRX, companies can keep those assets liquid. This capital can be utilized to trade, to invest, to provide liquidity to the DeFi protocols or to pay for day to day operating expenses. This financial freedom is a tremendous competitive advantage.

Unlimited Scalability, resources on-demand. Your businesses demands fluctuate. A business can have 50 transactions on a day or 500 ones during a promotion or high market times. Staking is taking a static, set amount of energy at any given time, this amount doesn't account for an influx of transactions and we all have seen how it doesn't take much to break the grid right now. Renting is a way for a business to rent energy on the Tron blockchain only in the amount needed at the time, so operations continue working without stalling or being over-provisioned elsewhere.

Automation and Control: Power of Sophisticated Rental Platforms

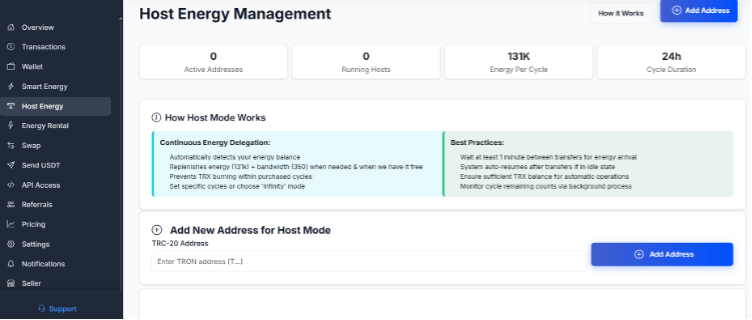

Power Management rental facilities are today's powerful rental tools for professional use. A prime example is Netts.io, which offers companies with robust solutions for their energy use.

The applied software that supports these systems consist of implementations of several modes that can be configured by the user, depending on his or her operational preferences:

- Manual. If your business does not have regular Power needs, or you are not able to predict your Power usage, the Manual mode will allow you to make a purchase on demand. It's a simple, pay-as-you-go solution.

- Smart Mode. This is the perfect fit for most businesses that has transactions on a consistent flow. A company can establish a minimum Energy balance for its wallet. When the balance falls below this level, the system automatically assigns new Energy. This makes the wallet hot and always readily available for trading without needing to be manually managed.

- Host Mode. Made for high-transaction operation such as exchanges, payment gateways, or popular dApps, this mode gives you round the clock non-stop supply of POW. It ensures that all requests are served in real-time, irrespective of the traffic.

Also, for compatibility, the top names in the industry provide a professional API. This enables companies to integrate the Energy rental logic directly into their software in order to fully automate an hands-off transaction cost management of it at maximum efficiency.

Conclusion: The Strategic Imperative of Growth

If I am "required" to stake TRX to get Energy, and get the same amount of Energy every 24 hours, then I simply cannot use this blockchain in any serious way whatsoever, can I? Yes, for a small time user with low volume and predictable transactions, sure, I can stake just enough TRX to sock up adequate Energy to match that low volume - but I do not think I am going to use the Tron blockchain in such a way that always leads to transfer-for-value happenings that are themselves predictable and low volume. The cost of tying up large amounts of capital, the rigidity and market risk inherent in an Energy hedge that cannot be cut and runs for upwards of a decade - all of these make renting look pretty like a smart choice.

With the help of Tron energy within the rental services users and enterprises are able to drop transaction fees by an order of magnitude, retain full control of their liquid assets and gain access to the powerful automation tools they can rely on with confidence to scale their business. In the highly-competitive ecosystem of TRON, deciding to delegate some Energy on the Tron blockchain is not just about saving costs, it is the bedrock of businesses positioning themselves for sustainable growth, nimbleness and fiscal prudence.