The TRON blockchain has proven, by mid-2025, to be more than just another cryptocurrency network but a powerhouse in global finance. The platform has more than 310 million user accounts and holds a staggering $78 billion US dollar-pegged stablecoins, enabling it to process an average of more than $20 billion worth of transactions a day. These numbers represent thing more than data to ponder; as a global transfer of wealth and power floats over digital railways that bypass the mechanisms of traditional finance; they represent a tectonic shift in the ways value is moved and stored. Behind it there's a fascinating ecosystem of visionary founders, maverick billionaires and an emerging caste of mainstream corporations wagering billions on TRON. Now we'll take a peek into lifes (and wallets) of TRON's titans.

The Founder-King: Justin Sun

Few folks are as colorful, and as polarizing, as TRON founder Justin Sun, the quintessential tech wunderkind and marketing magician who personifies the fast-moving, often reckless ethos of the crypto industry. His fortune is well into $2 billion territory, and is based on the ecosystem he crafted for himself. Although his holdings are across many different assets — from blue-chip art to equity in crypto exchanges — his influence is most forcefully exerted via his hands-on management and ingrained interest in the success of TRON. More monarch than CEO, the market perceives signals of the direction of the network in all his actions.

A detailed and intriguing portrayal of his on-chain footprint comes courtesy of blockchain analysis. Although publicly identified wallets owned by Sun reportedly contain hundreds of millions of dollars in assets, including TRX and the USDD stablecoin, the full scale of his power is almost certainly much larger. In fact, on-chain intelligence firms have claimed Sun controls a network of affiliated wallets that could add billions to his net worth if attributed to him. Whereas other founders may take a more passive, almost philosophical approach to building the company, Sun is an active, daily player in the market. His wallet activity reveals large token swaps, liquidity injections, and a fluidity of capital between the TRON and Ethereum networks which speaks of how he actively manages his digital empire. By engaging his own personal holdings for capital, he becomes a sort of a multi-tool: a market maker, a venture capitalist, and a liquidity provider, all at once, for each new project, at times of stress, helping each project in bootstrapping and stabilizing the whole ecosystem.

However, the impact of Sun goes far beyond the on-chain actions. Always one to get the news bells ringing, he has carried out large high-profile deals aligning the digital world with the traditional. His purchases include a $78.4 million Alberto Giacometti sculpture, a $10.5 million Joker-themed Tpunk NFT, a $12 million GameStop and AMC meme-stock investment, and a $4.57 million bid for the opportunity to eat lunch with legendary investor Warren Buffett. Stay in the news AND onsignificando that TRON is a legitimate financial power up there with the old guard, these moves are not just self-indulgent acts, they're glimmering PR masterstrokes. Every one of these headline purchases normalizes crypto wealth and embeds the TRON brand into the conversation of our culture.

The Corporate Convert: Tron Inc.

In our opinion, the biggest emblematic sign of a maturing TRON story has been its jump from the niche crypto world into the regular stock market. Then in 2025, a U.S.-listed Nasdaq company, SRM Entertainment, which considers itself one of the largest destination designers and manufacturers of merchandise for the world's largest theme parks such as Walt Disney Parks and Universal Destinations, announced an unprecedented strategy shift. The firm made a $100 million equity investment to establish a TRON Treasury Strategy, brought on Justin Sun as a strategic advisor, then rebranded its name and ticker to Tron Inc. (Nasdaq: TRON).

This move cannot be overstated. It stands as one of the very first cases of a publicly listed US firm, who already has dealings in global entertainment kingdoms, making a direct and significant investment into the native asset of an individual blockchain. Tron Inc. billionaire CEO Rich Miller told that not only will Tron hold TRX as a treasury asset, but will also stake TRX to earn a yield on it for the express purpose of providing a dividend to its shareholders. This is a strong confirmation, looking at TRX with the perspective that using and holding the asset will create more value for shareholders in the long-term than a traditional corporate treasury management. It's a bridge between two worlds, bringing the nitty gritty of the underlying mechanics of the TRON network directly with Wall Street investors and analysts, while paving the path that other corporations will inevitably follow. However, with this step it really transforms a classic entertainment corporation with a consumer-oriented nexus into more of a hybrid tech company with a highly variable bottom line based on the adoption and performance of a decentralized network.

The Heavyweights of the Ecosystem: Infrastructure Whales

And outermost are the large infrastructure platforms supporting TRON's daily activities. Ecosystem whales are the ones whose business models depend on the success of the network. Nowhere has this been more apparent than in acquisitions such as Justin Sun's investment into BitTorrent – the legendary peer-to-peer file-sharing network. Coupled with the historic user base of BitTorrent, the BTT token brought millions of non-crypto-native users into the TRON ecosystem overnight, and instantly created a user-adoption flywheel, while bringing a decentralized storage layer for the applications on the network.

In addition, cryptocurrency exchanges such as HTX (the former Huobi), Poloniex and other deep ecosystem exchanges serve as significant network gateways. They are the ultimate on- and off-ramps for the billions of USD worth of USDT and other assets moving through TRON on a daily basis. They are some of the largest and most active actors on the network by far, due to their massive holdings of TRX and stablecoins, necessary for keeping liquidity available at all times for their millions of customers. The TRON blockchain benefits from their operational success, from them being both safe and cheap to process deposits and withdrawals, making them true partners in the enterprise of making the TRON blockchain fast, cheap and robust. They are not merely users of the network; they are constituent parts of the network machinery itself.

The Rise of Global Adoption

The tales of these solo whales and corporate whales are a metaphor for a larger trend — the sacrifice of TRON network up-take as a reliable 1st layer settlement layer to the world right now (between the years). Those 310 million user accounts are not vanity metrics, they are represent nothing less than a global stateful nation of users and enterprises, predominantly in emerging markets in Asia, Africa and Latin America, who have chosen TRON's digital dollar rails over slower, more expensive and less accessible traditional alternatives. TRON isn't an investment for them – it's a means of commerce and saving.

This trust, that top players in the system have in this system, echoes out into the ecosystem. Such a move from someone like Rich Miller, the CEO of a public company who just put a hundred-million-dollar strategy on TRON will surely raise eyebrows; or from a visionary mind like Justin Sun's in putting all his personal fortune, re-allocating continuously to buy network's assets and expand its growth — is a whale with new tail. It represents a confidence that this technology is here to stay and may one day become the backbone of the next generation of finance. It's this confidence coupled with massive capital that fuels the network effect that attracts new developers, users, and capital to the network in a virtuous cycle — and it's this confidence that is a major force behind the powerful gravitational push of each of these networks.

But that ubiquity also introduces a host of new challenges, and those are almost always linked to operational efficiency and cost at scale. For a corporate treasury such as Tron Inc., who has millions of staked assets under management, or exchange handling billions of daily volume, transaction fees, no matter how small on a per unit basis, can add to a significant cost of operation. But here is where the maturity of TRON really shines with a mature service layer appearing to cater to its largest players.

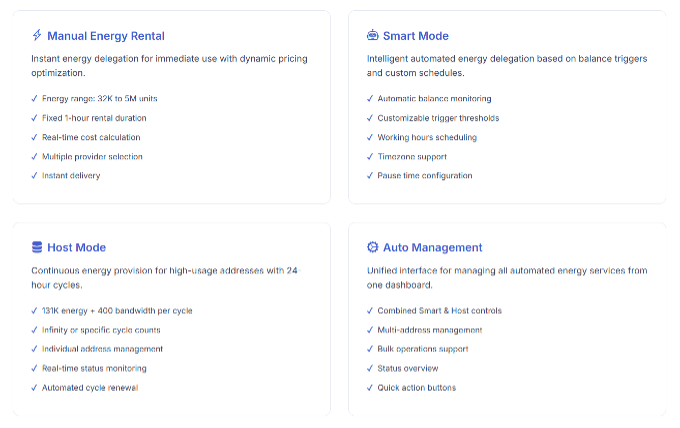

It is not a feasible strategy for these titans of the network to manually track TRX balances to fund Energy to pay for on a per-transaction basis. This is the time to work smarter, not harder, to automate processes and reduce costs. And so, a thriving Tron energy rental market has emerged. Sophisticated platforms like netts.io enable this large scale operations to schedule energy rent on demand on the Tron blockchain. A company can instead bid for the exact amount of energy they need over a handful of transactions, effectively reducing costs dramatically and maximizing capital efficiency rather than having to lock capital in TRX.

Not only are these Tron energy renting services helpful, but they also represent an essential pillar in the TRON whale's operational backbone. Such platforms provide automated, API-driven access to energy. Platforms like netts.io facilitate withdrawal to exchanges, free businesses to run their on-chain relations at the minimum cost, and opens up the door for large holders to efficiently and effectively execute their complicated DeFi strategies. This final, elegant layer of user-centric design — abstracting away the complexity for both enterprise and retail end users — turns a powerful but unwieldy blockchain into a truly usable and global financial rail.