Blockchain-based passive income is the digital siren song that lures so many investors into the cryptocurrency world, taking some of the effort out of making money work for itself. Aside from the tickers of Bitcoin and Ethereum, well-known for their high volatility that have made headlines all around the world, there is a whole global ecosystem of decentralized tools that allows users to do more with their assets, instead of just holding them. It's a veritable breeding ground for returns, especially across the fast and cheap TRON network. From the steady, foundational flow of staking rewards to the high-stakes, high-speed bet of new token launches, TRON brings a full range of enterprising user opportunities.

Yet this is not a world of free money, and it is important to treat it as such. Behind every tweet about a successful DeFi project are a thousand un-tweeted cautionary tales of loss — from misunderstanding or carelessness or sheer luck, because this is a market that favours neither. This guide aims to provide an expanded but realistic perspective on the actual income potential opportunities the TRON network has to offer in 2025. We'll dive deeper into the most common methods, explore the pros and cons with more nuance, and make more direct comparisons to traditional financial instruments in order to give you a complete picture. This is not a financial advice, but a deep dive into one of the most expansive maps you could use to navigate the opportunity and risk of earning on a blockchain that has become one of the busiest in the world.

How to Generate a TRON Income: Basics of Staking TRX

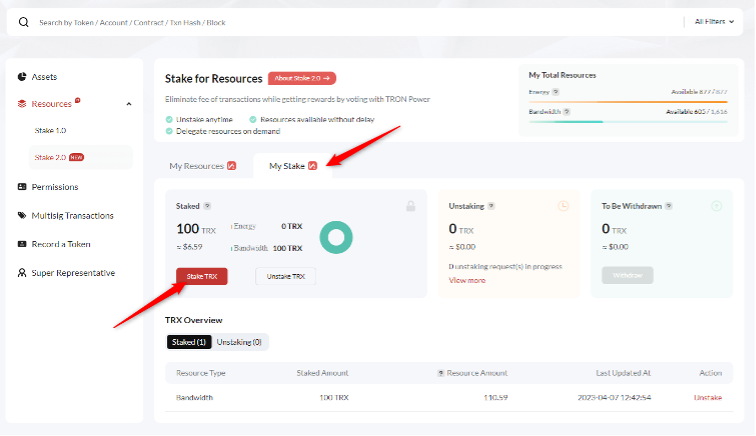

Staking TRX The easiest and basic method to make money on TRON is to stake your TRX. Staking is the process of the network's consensus mechanism. Freezing your TRX tokens also gives you the right to vote for Super Representatives (SRs) — the 27 elected bodies responsible for validating transactions and creating new blocks. You cast a vote which contributes to securing the network, and you are rewarded with a portion of the generated block rewards for providing this service.

The Underlying Mechanism

Other TRC-20 tokens can be frozen at any amount of TRX through a wallet like TronLink. This will turn your liquid TRX into "TRON Power" with a ratio of 1:1 and you can choose between Bandwidth or Energy. After that, you vote with your TRON Power for the SR(s) of your choice. The trick is being selective with what SR to choose, some of them have varying reward-sharing percentages to them, as well as different payouts. This is where SR stat tracking websites come in handy, alerting you of their uptime, how they distributed rewards and their total votes. It is similar to selecting a fund manager, but a more immediate and open relationship.

Pros and Cons

Pros. This might be the most stable option for "active" earning in TRON. Your funds remain your assets inside your wallet, and you never hand over control to SR. This is a native protocol function, so it makes the process more powerful and dependable. The gains, though not life-changing, are steady and compounded over time.

Cons. Your TRX is illiquid while frozen There is a minimum freeze time of 72 hours but your assets need to stay staked to receive rewards. This creates an opportunity cost; so you are unable to use that TRX for trading or other investments. In addition, the rewards are also based on TRX and so its dollar value can fluctuate widely. If the price of TRX is rising, then having a 5% APY in TRX is fantastic; if the price of TRX is falling and faster than you're accumulating rewards that feels a lot like a treadmill.

A More Practical Situation

Continuing with the real-world example of a long term staking - for example you purchase $6,000 worth of TRX at $0.3, that is 20,000 TRX. You stake it and receive a return of 4.5% per annum. In one year, you then have 20,900 TRX. Your TRX is now worth $6,270 (lets say if TRX price stayed the same) which translates to a profit of $270. In a bear case, however, a $0.25 TRX price gives you $5,225 for your 20,900 TRX — a net loss even though you hold more of them. The very essence of staking is this duality of exposure to staking rewards and market volatility.

Unlike traditional finance, staking is often juxtapositioned to a high-yield savings account but might be more accurately compared to a foreign currency bond. You are essentially loaning your capital to collateralize the network (similar to purchasing a government bond) while earning an interest rate in return denominated in a foreign currency, the foreign currency in this case being none other than a super volatile stable currency (in TRX). The danger is not in the "bank" (the protocol) failing, it's in the currency itself losing value to your home currency.

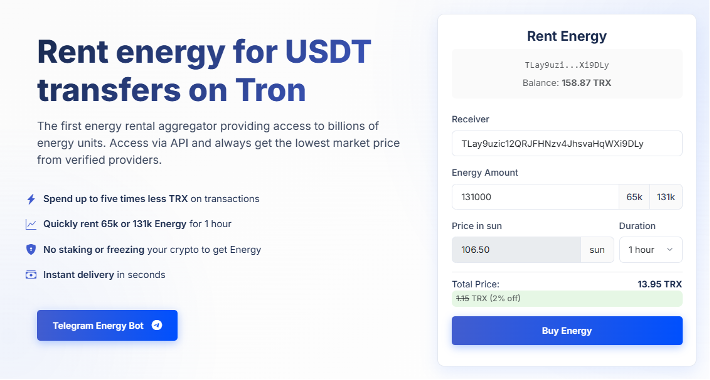

The Baron of Energy: an Entrepreneurial Journey

A less mainstream (but more entrepreneurial) approach to earning income on TRON is utilizing the protocol's resource model. Since every interaction with a smart contract (a USDT transfer, for example) requires Energy, a market for it has been established. Tron has a feature where users can freeze their TRX and earn a wealth of Energy in return, so people with a lot of TRX just freeze it and sell their Energy to other users.

This is the business logic behind the whole ecosystem of Tron Energy rental services. Adding this 1/100 penalty on the curve naturally forces these providers to run a utility business on the chain. This means you pass the resources you produced on day to another user address for the fee which has been supported by TRON protocol directly and users can complete it via explorer like Tronscan. But this is not a joke. Compared to existing Tron Energy rental services, it not only needs to freeze millions of TRX, dynamic price according to demand, but also have to operate online 24 hours to accept orders.

For most, the very accessible "revenue" result of this system is indirect: cost savings. Consider it as protecting revenue. All the TRX that you do not use on fees are all the TRX that are going to be left in your wallet. If a business makes 50 USDT transfers a day, direct TRX burning would mean ~27 TRX are paid for each transfer, totalling 1,350 TRX in daily fees. However, you can decrease this amount to 3-4 TRX per transfer (or 200 TRX a day, i.e., renting Energy on TRON blockchain) by simply using an Energy renting service. That's about 1,400 TRX a day, 40,000 TRX a month, saved. This is not merely an optimization but an effort for massive operational savings that improve the top line, directly.

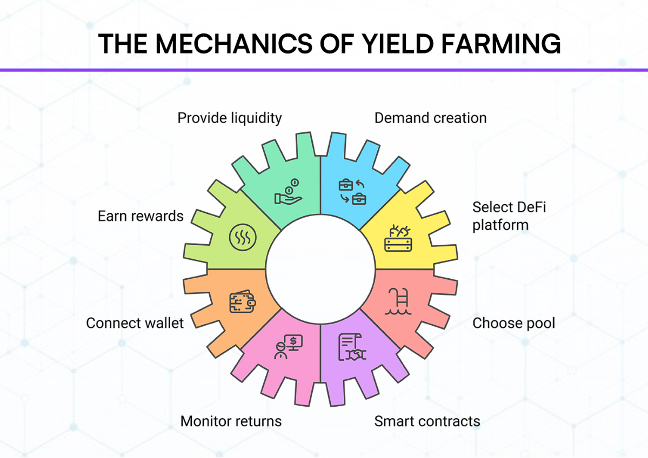

Risky Business - Liquidity Providing & Yield Farming

Meanwhile, those who are thirstier for risk can earn much greater returns through Decentralized Finance (DeFi) on TRON. SUN is a liquidity provider (LP) token earned by depositing a pair of tokens (e.g., TRX and USDT) into a liquidity pool [at] Decentralized Exchanges (DEXs) (e.g., SunSwap). This allows others to trade against you, and in exchange for it, LPs receive a share of the transaction fees.

Impermanent Loss

This is arguably the most significant risk for LPs. For example, when TRX price is $0.12, you put 1,000 TRX and 120 USDT into the pool. Your complete deposit is valued at 240 bucks. Hypothetically, lets say TRX moons to $0.48. Your pool will be used by arb traders to buy the cheapest priced TRX and will rebalance your position. On withdrawal, you will receive 500 TRX and 240 USDT. Now your 480 worth of holdings are netting you $480 Great, right? However, if you had just held your original 1,000 TRX and 120 USDT, your assets would be worth $480 + $120 = $600. That $120 is your impermanent loss. This risk is partially mitigated by the high APY from fees, however, it's always a race.

Even available impermanent loss: There are additional dangers. Bugs in smart contracts or loopholes could cause the loss of all of the funds that have been deposited. The DeFi platform itself may be the scam. And you are your own security auditor now.

In other words, this is the crypto version of a market making firm in a stock exchange or some leveraged commodity trader. This potential for gains, both rapid and outsized, is real — so too is the potential for losses, rapid and significant. Active management, understanding of the complexities behind it, and a strong stomach for volatility are needed.

Wild West of New Token Speculation

The riskiest end of the scale involves putting money into new tokens — often immediately after they are made. The glamour is taking a chance to be the initial investor in a project that becomes a "100x". The cost-effective aspect of token creation on TRON has seen new projects consistently flow into the ecosystem.

But this is the most difficult arena. The overwhelming state of new tokens will never launch or are fraudulent in what is known as a "rug pull", where developers simply disappear and take the investors money with them. Due diligence is incredibly difficult. You would check for a whitepaper, public team, and fair tokenomics — but faking those are the easiest part of scamming someone.

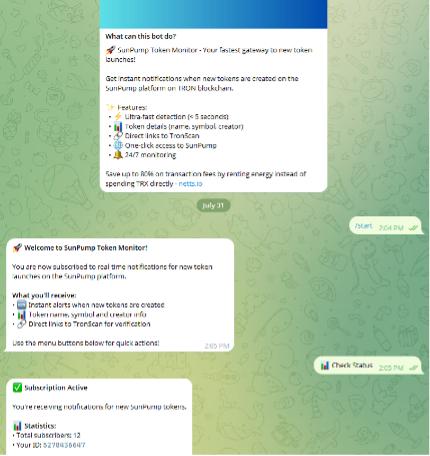

If you get the unimaginable risks involved, tools that are just faster becomes a no-brainer. Something similar to the SunPump Token Monitor bot from netts.io, which is made for this high-stakes game. This means you get notifications typically within five seconds if someone creates a new token on the SunPump platform. It provides you with all the uncompromising data like the tokens' name, symbol, and a link to TronScan. This means a speculator can come in before the wider market has heard of the token.

It's critical that we understand what a tool like this can do. It is a repository of information but not intelligence. It gives you time, not quality assurance. It does not "approve" the token. Using one of these is like heading into the eye of a storm; you are going straight into the centre of the most volatile and chaotic part of the market and you need to be ready for whatever comes next.

Conclusion: Map Own Your Journey with Work and Prudence

The TRON network is more than a technology, it is a vibrant digital economy full of income-generating opportunities. It runs the gamut from the careful staker looking for reliable low, single digit yields all the way to the DeFi enthusiast wading through the quagmire of liquidity pools to the high-rolling speculator looking for 100x-plus rewards in the booms-and-bust world of newest token trading.

There is not one "best" way to make money. So, what is the right approach is a subjective matter that depends upon your own financial aspirations, you the level of risk you can take, your availability of time and money into this venture. Investing in knowledge pays the best interest. Read, learn, and question everything. Know what is behind the yields, be ruthlessly honest about the downsides and simply never, ever, invest more than you can afford to lose. Adopting a cautious, educated, and careful method, you can explore the exciting world of TRON income and even the potential of new streams of revenue in the growing digital economy.