It was solved with an easily communicated, highly impactful, and perfectly timed promise: nearly zero transaction fees enabled through a blockchain. When it first broke onto the scene, TRON's marketing of being "gas-free" was a stroke of genius, offering a direct answer to the high fees and slow speeds which hurt networks such as Ethereum. It worked spectacularly. Fast, almost-free transactions attracted users and developers alike to TRON.

Over 2024, the network was able to solidify itself as a powerhouse, hitting millions of transactions a day and establishing itself as the top dog for stablecoin transfer, mainly for Tether (USDT) domination through the mid-2025. Line for line, TRON was the highway for digital dollars, for many.

But away from the cameras, things were not quite as rosy. However, as the network matured, that almost gas-free dream of elegance began to teeter, and soon became a complex and often expensive reality. As it dawned on its massive user base that 'gas free' didn't mean 'free to use' at all, a creeping sense of disappointment set in. What went wrong? And the secret is not just about TRON and its one-of-a-kind resource model, but also the burgeoning, stage star of its story − the user-oriented market that grew up to remedy its limitations: TRON energy rentals.

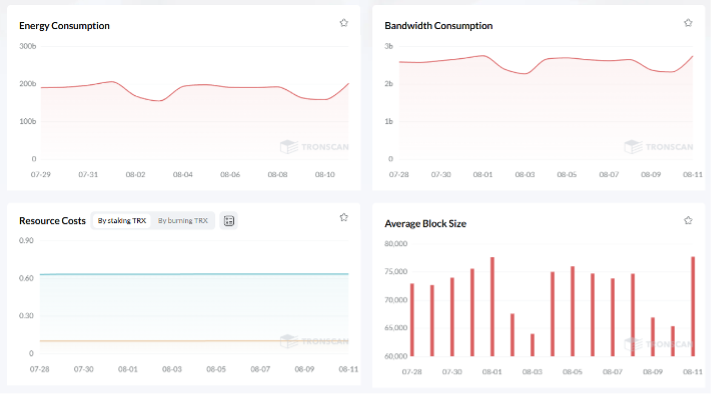

Bandwidth and Energy: Larger Perspective

The traditional gas model is not applied to TRON's fee system at all. It does not use a single gas price which changes over time, instead it is based on two separate resources, Bandwidth and Energy. The difference is what helps us understand user frustration.

- Bandwidth: This the less esoteric resource. For example, non-computational transactions like sending TRX (TRON's native token) or other simple TRC-10 tokens. Each TRON account that has been activated also comes with a daily quota of approximately 600 free Bandwidth points. This means around two truly free transactions a day since an average TRX transfer takes around 250–300 points. This is the technical basis for the "gas-free" claim that TRON uses, and it is correct for this specific use case.

- Energy: This is where things start getting tricky. Energy is a measure of computational power and it is consumed in far more complicated operations which interact with the TRON Virtual Machine (TVM), namely smart contracts. Most of the actual "stuff" that users care about gets categorized here: moving TRC-20 Tokens (never forget my USDT), DeFi stuff, NFT minting, you name it.

Herein lies the element of the dilemma. However, unlike Bandwidth, the Energy is not free and regenerates each day. Energy does not have a free daily allowance.

To get your hands on it, users have two main methods — neither of which is "free":

- Freeze TRX: Users can freeze the TRX they own to have a continuous spot of Energy. Although for high-volume users, this is likely the cheapest solution, but has its major downsides. You must stake anywhere from a few bucks to well over a thousand in TRX to have enough energy to use it regularly, and it must be staked for no less than 14 days. If you are an average user who just wants to transfer a few USDT, this is very hard to use and capital inefficient, which is why it cannot be used for normal USDT transfers.

- Burn TRX: If the user executes a transaction without enough Energy, the network simply doesn't process it. Transactional bans aren't a thing though. And rather, it auto "burns" TRX straight from their wallet to pay the computational cost. For millions of everyday users, this is the default situation, and it can be astonishingly pricey, making the "cheap" exhortation of the organization totally pointless.

Who Pays the Price for "Cheap" Transactions and the Empty Wallet Penalty

The burning cost of TRX for Energy was debated and disappointed users the most. For a regular USDT transfer, it takes up 65,000-131,000 Energy, equating from $5 to $9 per transaction once in $TRX. If you are trying to save using USDT in an emerging market, or if you are using USDT for small scale commerce then these costs are crippling.

And this is compounded with a technical nuance oft-referred to as the "empty wallet penalty." If you want to send USDT to a wallet or an address that will never hold USDT, such as one that you just created, you will need double the Energy (around 131,000). This is because the transaction has to create a new token record for this token in the receiver's address on the blockchain. New users miss this detail often leading to sticker shock, and a healthy dose of frustration. These ideals of a frictionless, cheap, and low-cost network were colliding with the unforgiving economic reality around the resource model.

A Gilded Cage? TRON Taking Over & Resulting Problems

Despite the grumbling, TRON's hold on the top half of 2025 appeared untouchable. Analytics reports by companies such as Messari and CryptoRank revealed an overwhelming success. USDT supply on TRON blew up to more than $81 billion — over 50% of all Tether circulating — and the network itself racked over $900M worth of revenue in H1 2025. These were not vanity metrics — they corresponded to an ultra-deflationary economic model of hundreds of millions of dollars worth of TRX being blasted through transaction fees.

However, this throne, built almost entirely on USDT transfers, has turned into an Achilles heel. Come August, 2025 news struck like thunder on the TRON community as Tether announced, in collaboration with its sister company Bitfinex, it was building its own zero-fee blockchain (dubbed "Plasma"). Plasma aims to provide USDT transfers that are genuinely free and native. This is a direct, now an existential threat to TRON.

So, while this is going on, what reason is there for the majority of users to continue using TRON, if the issuer of USDT himself eliminate the #1 reason behind the usage of TRON, which is: good old cheap USDT transfers. TRON's kingdom, built on top of borrowed demand for someone else's product, looks instantly very flimsy.

An Alternative Grows: Consumer Utility Token Rentable Energy Economy

Realizing that the TRX burning fee was too high to keep the community happy, and well before we had the Plasma threat problem, the TRON community created its own solution. And, a brighter industry segment emerged to fulfil the key pain point: Tron energy harnessing.

And thus came the platforms which enabled users to rent Energy for a period of time — anywhere from one hour to multiple days — at a fraction of the price it cost to burn TRX and make the Energy. It sets up a fantastic, mutually beneficial marketplace.

- Providers: Large TRX holders who have staked their tokens to generate Energy can lease their excess, unused resources to others, earning a steady, passive income on their assets.

- Renters: Everyday users who need Energy for transactions can rent energy on the Tron blockchain for just the amount they need, precisely when they need it. They avoid having to lock up their own capital in staking or paying the exorbitant and volatile burning fees.

The savings are dramatic. Renting 65,000 Energy — enough for a standard USDT transfer — can cost as little as 3-4 TRX. Burning the equivalent amount of TRX could cost 14-28 TRX or more. This represents a potential saving of up to 80%.

The emergence of Tron energy rental services has fundamentally changed how savvy users interact with the network, providing a flexible and far more cost-effective alternative.

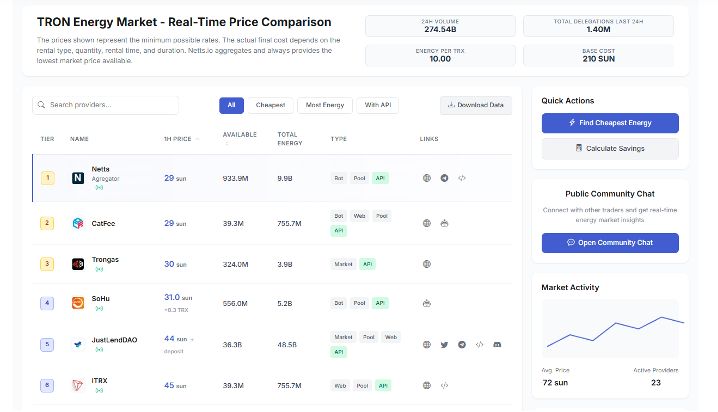

The Aggregator Advantage: Case of netts.io

The energy rental market has matured rapidly, evolving from simple peer-to-peer arrangements to sophisticated aggregators that offer even greater efficiency and ease of use. A prime example of this evolution is the netts.io ecosystem.

Netts.io solves the fragmentation of the rental market by acting as an energy rental aggregator. It connects users with a vast pool of energy providers, automatically securing the lowest market price at any given moment. This removes the friction of shopping around and comparing rates. More importantly, its features directly address the pain points of the native TRON experience:

- Instant Access and Predictable, Low Costs. Users can instantly rent the exact amount of energy needed for a transaction, transforming the unpredictable cost of burning TRX into a small, fixed, and transparent fee. It promises savings of up to five times the cost with burning.

- One-Click Automation and Peace of Mind. Automated tools are included, such as instant balance monitoring and even a telegram bot on the go for rental activities. Users will never have to think about ever having a transaction fail due to lack of Energy or at unexpected high fee with this "set it and forget it" methodology.

- Professional Business Package. For developers and businesses who are having high transactions which are dependent on TRON — netts.io has a full-service API to automate energy procurement, a professional workspace to conduct transaction cost and time efficiency analysis, and comprehensive financial management tools.

Platforms such as Netts are able to provide a powerful but smooth gateway to the energy market. Ultimately, it is the market-driven solution to the fee problem at the protocol level on TRON. These abstract the complexity of the Bandwidth and Energy model, which is confusing and expensive, and deliver on the true vision for low-cost transactions.

Final Thoughts: Market At Crossroads

The history of TRON, from "zero price" patenting to the third-party energy renting monopoly, has become an interesting and continuous case study of the mechanism design of blockchain. The original vision served as a great PR tool to achieve record adoption and build a multi-billion-dollar revenue powerhouse. Nonetheless, its resource model in practice pushed away a lot of the users and imposed a heavy cost a lot of the time on its primary use case.

This user discontent, in turn, led to ground-up innovation. The emergence of a mature energy rental market is proof of the strength of the crypto community to create innovative solutions to supply-and-demand problems. However, this entire ecosystem has now reached a tipping point. If Tether gets its Plasma chain up and running, TRON might see its primary value proposition get undercut.

It might not be the protocol that determines the future of TRONs usability — and maybe their very relevance — but the creativity of the markets which have arisen, composed of users trying to patch the holes in the wreck, ever searching for a way to accommodate the profound changes on the horizon.