As the TRON network continues to establish itself as a behemoth in the realm of dApps, how resource model actually works is no longer a backdrop issue for developers alone, but a drew upon the mind of millions of users every day. What keeps the TRON Smart Contract engine going is the lifeblood called "Energy". And every person who has ever had to send USDT has asked himself the question: do I need to burn a truckload of TRX to cover for low single digit US cents or is there a more efficient way? This trend has spawned a lucrative market for "Tron energy rental services," a fix that can lower the transaction's cost by as much as 80%.

But this market is anything but homogenous. Renting Energy is what you make of it, from a purely manual transaction to an entirely passive "set it and forget it" process. The difference is the degree of processing automation provided by a platform. For those consumers with an eye for managing both cost and convenience, the distinctions are important to know. In this post we'll have a look at a range of automation in Tron energy rental from the very basics up to a really efficient option when it comes to an aggregator model.

Reference: Webform Purchases

This is how you can rent energy on Tron blockchain in the simplest way possible. This is the mother model that other services are composed upon. It's like a vending machine: You know what you want, you put in the money and you receive it.

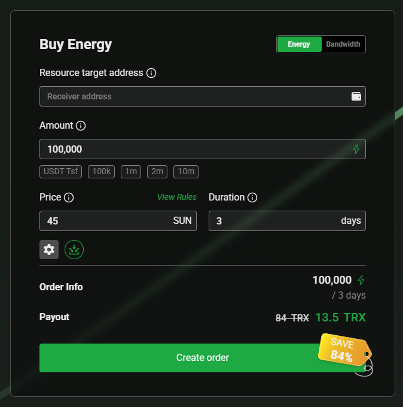

Services that provide this functionality show a basic web form. A user lands on the site, then types the TRON address that requires the Energy, followed by the amount required (usually 65,000, if you are transferring to a USDT holding wallet, and 131,000 if you are creating a new wallet) and finally the term you would like to rent the energy for, ranging from 1 hour to a maximum of 30 days. The price is being calculated, let's say in TRX, the user connects his wallet (like TronLink) to it and pays for it, then in no time the Energy is delegated to your chosen address.

The advantage of this model is its simplicity. There are no contracts to sign or complicated installations. For a user that only does a few USDT transfers per month, this approach can work just fine. Yet, it fails in these tasks with increased use. The process is cumbersome, manual and involves active-manual-intervention for each and every rental. The latter user needs to mind that he has to rent Energy before he can perform a transaction, and, since that user can only acquire from one source, they can only hope it is the best price of the market for that point of time. One missed Energy rent alone can result in an expensive TRX burn that costs more than the several previous rent savings.

The First Leap: Introduction to Automation with APIs and Bots

Some platforms try to alleviate the pains of this manual process and offer scripts or even more advanced solutions for more experienced users. These are shifting approaches from a reactive "pull" model (user pulls the Energy manually), to a proactive "push" model in which the system can rent out based on set triggers.

Business and Developer Appeal: Power of the API

An API (Application Programming Interface) is a set of rules and tools that allows different software applications to communicate with one another. In the case of Energy rental, the API allows a business - whether a cryptocurrency exchange, a payment processor, or a dApp developer - to incorporate the rental service into their business operations programmatically. Platforms like itrx.io and feee.io and other platforms are built with API access in mind.

So, rather than a human manually filling out a form, a business's software could make an API call and rent Energy for a user's address just before processing a transaction. For instance an exchange can add this to their withdrawal system. When a user applies to withdraw USDT the backend of the exchange automatically calls the API and delegates energy to that wallet to make that transaction with the lowest fee. This is automated efficiency in action at scale.

For the Power User: Appeal of Telegram Bots

For average users that typically might not be able to handle an API, but who might still want automation, Telegram bots have proven a popular solution. Platforms like feee.io with their "TG Robotics" and aggregators such as Netts.io introduce you to some advanced Bot, your personal automatic Energy manager.

These bots are convenient to the point where their functionality is really a game changer. Users can usually link one or more of their wallets to the bot and deposit TRX in a "smart" manner. After that, everything is in the hands of the bot. It can be set to watch the wallet and rent it Energy automatically on the up when the wallet value is less than a certain amount, or even more advancedly: when an outgoing transaction (or series of) is detected that will need Energy. Some services, like itrx.io, even tout "intelligent account management" that can learn from a user's transaction history to predict the user's needs. The "set it and forget it" nature of this means that the user doesn't need to give any thought into Energy and can always be sure they're ready for a purchase.

Apex of Efficiency: Aggregator Model

Whereas the APIs and bots recognize and codify the transaction that is renting Energy, a new, more sophisticated class of smart contract has entered the scene which now automates the market dynamics of the renting of Energy: the aggregator. An 'aggregator' is a meta-platform which interfaces with several independent "Tron energy rental" providers. It doesn't own the Energy it, in turn, offers a consolidated interface to a large, competitive marketplace for customers.

An aggregator platform like Netts.io is the best in terms of automation and ease for few reasons:

- Automation of Price Discovery: The most inherent value proposition of an aggregator is the automation of price discovery. It's constantly checking down the prices of hundreds of providers in its network. If a user wants to rent an Energy, the aggregator instantly finds which supplier provides the lowest price in the required amount and period and forwards the order to that supplier. This means that the user receives the best market rate available without having to manually go to compare different platforms.

- Automated, Trustworthy Fulfillment: A client can rely on the aggregator to have correct information about an item, and for it to be fulfilled as a link. If one supplier has stopped having Energy the aggregators' system automatically goes to the next-best-priced supplier for the record (as they offer it), meaning the user's order can almost always be executed on the spot. This helps to reduce the risk of dependence on one source of supply.

- Unified Automation Stack: Aggregator tools would usually include the same set of automation features as the direct provider e.g., a full-fledged API and a Telegram bot.

Feature Unbundling, unbundling subscription features specifically, involves not providing the "full" set of features where and when people need them. The critical distinction is that those tools are superpowered by the aggregator's market intelligence. A business utilizing the API of an aggregator is not simply automating rentals, but automating rentals at the lowest available price. A user with an aggregator's bot isn't just receiving automated wallet top-ups; they are receiving top-ups from the most competitive seller that exact moment.

This double layer of automation-automating the market research on top of automating the transaction-represents a compounded efficiency in terms of cost and time savings. It is one of the most advanced and user-friendly TMCs on the rental market.

A Closer Look: Netts.io Energy Market in Action

To better understand the potential benefit of publishing in aggregate, a case in point such as the Netts, which have gone live, are particularly informative. io Energy Market. This is not just a rental form, it is a vibrant, dynamic platform, which takes the rental phase of a tenancy to a whole new level of sophistication.

The market offers its own public order book which accompanies a live stream of all verified Energy providers available on the network. At any specific time, a user will view a list of offers, with each offer having an associated price (usually in SUN per day) and the total amount of Energy accessible from that offer, this alongside the rental period. This kind of transparency means users don't have to trust the aggregator blindly; they can just see the state of the market for themselves.

The real innovation, though, is in the smart order matching engine. When a player requests a sizeable quantity of Energy (5 million for a 7-day rental, perhaps), the Nets. 12 and I don't have a single provider who can fill it. Instead, its algorithm sweeps through the full order book and puts together the best package that it can. It could fill the first 2 million at the cheapest price from Provider A, the next 2.5 million at a slightly higher price from Provider B, and the remaining 500,000 at yet a higher price from Provider C. This process called "partial fulfillment? ensures that the user receives the best possible blended price, taking the cheapest available Energy across the market.

This builds a strong, two-sided marketplace. Renters enjoy the best available prices and high reliability, and Energy providers have access to a more huge, aggregated pool of demand and they don't have to invest in building out enterprise- grade user-facing technology. Solely by visiting the Netts.io market, create another revenue stream for providers who are able to rent their frozen TRX to users worldwide. It is this perpetual competition and strong liquidity that makes the aggregator model the best of its peers and the most ideal form of Energy lease in TRON-network.

Picking the Best Strategy for You

The market of Tron energy rental is so varied that we can find a product for any user. Which you use depends on what you need to do:

- Not-So-Often User: If only making a few USDT transfers a month, the ease of a manual buy from a direct provider might be enough for you. There is just too much time spent on configuring an automatic system with no added benefit.

- Frequent Trader or dApp User: If you transact multiple times per week, automation becomes priceless. Here a Telegram bot comes out well. Better if contracts from an aggregator's bot, it's a combo of automation convenience and the low cost obtained by entering guest market altogether.

- Business or Developer: Any commercial developer will need an API. An aggregator's API is the best, only because it offers the needed automation, and these crucial benefits: Many APIs offer sophisticated pricing rules through intelligent order matching; the ability to handle a very large supply base.

The tools that allow users to interact better with a growing TRON ecosystem will be more and more important moving forward, after all. The progression of the services that Energy renters have gone from the introduction of simple manual advertising feeds, to intelligent, market-aware aggregators is a reflection of the creativity of the community. How it pertains to the average TRON user in 2025 and beyond, is learning how to wield this automation is the first step.