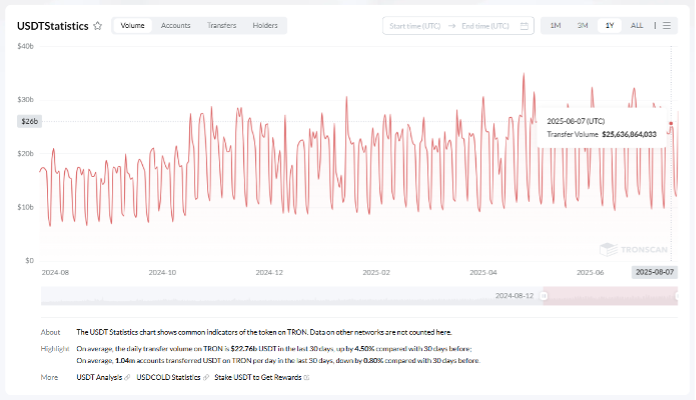

Stablecoins have become the foundation of the crypto market in an ever-changing digital finance world. These combine the price swings of regular crypto assets with the steady security of an on- or off-chain fiat currency to create the best of both worlds — allowing speedy, border-free trading in a stable, familiar framework of values such as the U.S. dollar. The sheer combination of value involved with many of these is massive, with Tether (USDT) being the biggest of them all, paving the path for billions of dollars in daily transactions.

However, they are not all the same USDT. In august 2025, the variant of USDT you select can have a drastically specific effect on how speedy, expensive and easily you may transact.

The majority of USDT variants are based on two giant blockchains: Ethereum (ERC-20) and TRON (TRC-20). Over the years, users have chosen sides. The technical evolution of these networks alongside the forge of new user centric tools has resulted in a distinct leader. This article will explore what makes USDT on TRON and Ethereum so different and dive into the competitive context, and finally explain how for the nearly all of the users of USDT, the TRC-20 standard has become the bona fide winner for payments and transfers.

ERC-20 vs TRC-20 Test: Main Differences

But before looking at the stablecoins themselves, it is important to look at what they are built on. Token standards are rules and specifications on a blockchain, defining the way a token is used, created and issued. This makes certain all tokens of that standard can interact in a predicted manner with wallets, exchanges and DApps in that ecosystem.

A new way of creating fungible tokens on the Ethereum network came with ERC-20 standard. It defined a standard for the creation of tokens that paved the way for the Initial Coin Offering (ICO) craze, and the DeFi (Decentralized Finance) explosion immediately thereafter. The best part of Ethereum is the best security, the longest history as a smart contract chain, and the largest ecosystem of dApps and developers. But, that popularity has a price.

Scalability is one of the oldest problems within the Ethereum network. Despite its move to Proof-of-Stake still experiences network congestion during once-in-a-decade demand spikes, resulting in transaction times so slow that they would be intolerable in any other context and the dreaded gas price (transaction fee) hitting astronomical highs at least once every 24 months. A single ERC-20 token transfer can cost anywhere from a couple of dollars to upwards of fifty dollars during peak conditions.

At the other end of the spectrum is the TRC-20 standard that is based on the TRON blockchain.

TRON was created based upon a different set of principles with high throughput and low-cost transactions as its number one priority. The network operates using a Delegated Proof-of-Stake (DPoS) consensus mechanism that enables it to accommodate far more transactions per second (TPS) than Ethereum by orders of magnitude, even numbering in the thousands. As a result, the network allows for ultra-fast, often confirming transactions in under a minute and extremely cheap as well. Generally it will cost only a small fraction of its Ethereum counterpart for an average TRC-20 transfer. And this simple difference in infrastructure is the main reason TRON has almost completely replaced ETH as the network of choice for stablecoin transfers.

TRON Transaction Model: Energy and 'Catch-22'

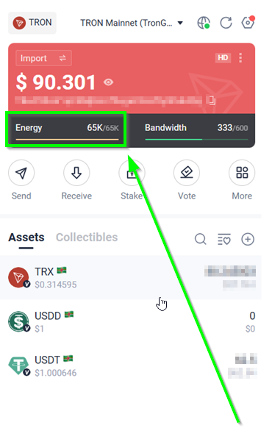

In order to make sense of how TRON is able to charge such low fees, you must understand how its resource model works because, instead of a variable gas fee in TRON's native coin TRX, what users are working with are "Bandwidth" and "Energy."

- Bandwidth. This is the basic resource for various transactions, such as sending TRX. TRON provides free Bandwidth Points to every TRON account each day, sufficient for several basic transfers.

- Energy. This resource is consumed when a smart contract is executed Every transfer of USDT will cost Energy since it is a smart contract token.

So now we are in the crux of the problem that has lost many TRON users to date: to freely use Energy, you have to "freeze" (stake) a very large amount of TRX in your wallet, or the network will just "burn" a little of your TRX to pay for it.

This sets up a classic "Catch-22" situation. Even if a user has tens of thousands of dollars in their wallet in USDT, if they have 0 TRX, their funds are as good as frozen. They are unable to send their USDT because they do not own some TRX to get the Energy cost to send it.

As we dive deeper and deeper into the mechanics, this has typically left users holding a hot potato and resorting to a tedious multi-step process through a cryptocurrency exchange to obtain TRX in order to then withdraw that TRX to their wallet to actually complete the USDT transfer they ever wanted to carry in the first place! While speed and cost are powers of TRON, this friction has remained the biggest hurdle to TRON adoption. This led to a solution where users were able to rent Tron energy rental which is basically a market for people to pay a small fee and be able to use the resources they need.

Broader Stablecoin Arena

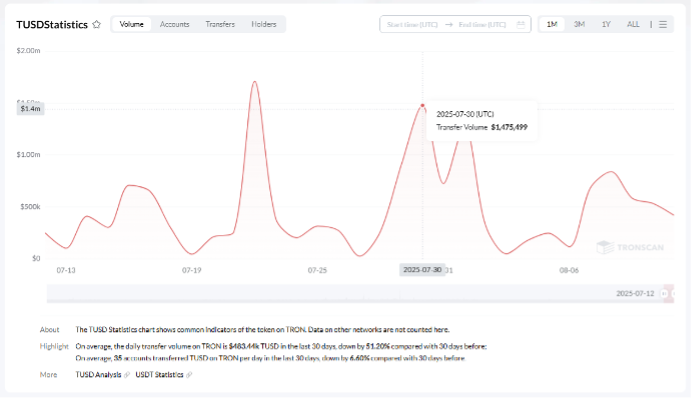

USDT may be the leader in the market, but it is not without competitors. Diving into 2025, the stablecoin landscape is more competitive than ever, with big players and challengers alike throwing their hat into the ring for stablecoin dominance.

- USDC (USD Coin). USDC is fully backed by Circle and Coinbase, and after years of development has become one of the most trusted regulated audited US dollar stablecoins in the market. It is also supported on several blockchains — including TRON and Ethereum. It is a powerful competitor of its own and in the most regulated markets, it has the upper hand, however, USDT is still far higher in every global trading volume and liquidity, and therefore the de facto standard in most of the world.

- DAI. A decentralized stablecoin that's backed by a diversified basket of crypto assets, held in smart contracts (as opposed to in bank accounts like most other stablecoins). Censorship resistant, it is an absolute marvel of DeFi engineering, and crypto purists love it. Its dependence on crypto collateral, though, necessarily makes it a more complex and perhaps less stable coin compared to its fiat-backed peers during extreme market volatility. This is not for the average user that just needs a simple digital dollar, but a small, but valuable segment of the market.

- Fiat-backed alternatives like Pax Dollar (USDP) and TrueUSD (TUSD) are also regulated competitors. While reliable and clear-cut, they have never managed to gain the USDT and USDC level of network effect, which made their utility and adoption quite restricted.

This kind of healthy competition notwithstanding, there's a reason why the king (USDT TRC-20) remains a king. This speedy, cost-effective, and unmatched liquid attribute is what makes it the most ideal option for global payments, migrant labor remittances, and trading. This left the only remaining obstacle being the user experience friction associated with the Energy requirement.

Last Piece of The Puzzle: TRX-Free Transfer

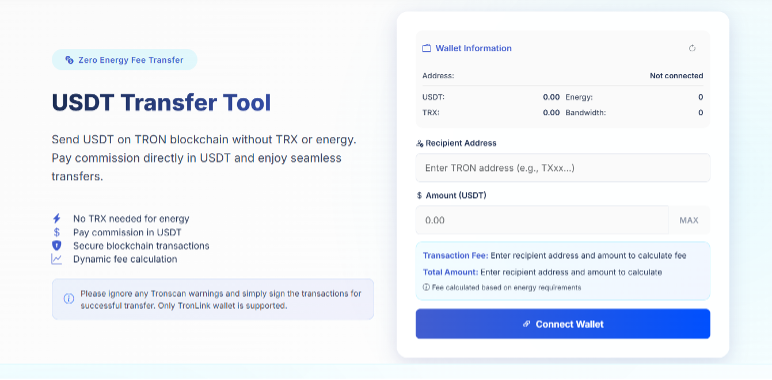

Innovative new tools have now comprehensively solved the "Energy Wall" problem, which was the last barrier to seamless USDT TRC-20 adoption. At the forefront of this is a service called netts.io, which offers a tool called "Zero Fee USDT Transfer" that allows users to stop holding or managing for TRX at all.

This type of tool signals a significant change in UX from a clunky, multi-stepped process, into an intuitive seamless flow. Here is how it works:

- Get connected & input your info. the user connects their existing TronLink wallet with the tool and only needs to input the receiver's address and the corresponding USDT to send over.

- Sign & approve. The tool calculates the transaction fee amount using the cost of necessary Energy and shows it to the user as a small commission in USDT. First, however, the user approves the USDT fee with two transactions executed within his sealed wallet environment, and second—they approve the main transfer of the stablecoin circulated. Importantly, the user private keys do not leave their wallet, making the process entirely non-custodial and safe.

- Transfer sent. After that the service immediately assigns the exact amount of Energy required for the transaction and sends it to the blockchain. Its one of the fastest method of cash transfer that the entire process is done in seconds.

It abstracts the complexities of Bandwidth, Energy and TRX away in a way this elegant. And this makes sending USDT on TRON as simple and seamless as it always was designed to be. It blows the "old way" of purchasing and withdrawing TRX from an exchange out of the water, saving users time, hassle and money.

In addition, for businesses, it gives a brand new recipient-paid fee mannequin. An exchange or an online merchant can simply carry the small USDT commission on behalf of their customers so that deposits will never fail as a result of having no Energy. This removes an entire segment of customer support tickets and enables a payment experience that is as seamless as traditional FinTech.

Conclusion: Obvious Decision in 2025

In tokenomics, the competition among stablecoin networks is not just a competition of white paper technical data. This is about how the user experience shows itself in the wild. Although Ethereum is still the heart of decentralized finance, high fees/slow speeds mean it is not a good option for everyday payments and transfers.

TRON network architecture is inherently the most stablecoin friendly environment when the goal is processing speed and low cost at mass adoption levels. Given its unparalleled liquidity and penetration in most crypto markets, USDT was the obvious choice of stablecoin. The only damper on this idyllic partnership was a little static with the Energy resource model.

That friction will be gone by August 2025. Integrated solutions like the netts.io. The transfer tool has closed the last mile, allowing users to never have to think about TRX, Bandwidth, or Energy again. These tools have effectively unleashed the full potential of the TRON network by allowing fees to be directly paid via USDT from an existing wallet. Together they ensure that USDT TRC-20 is not only the quickest, cheapest, but the most convenient and accessible way for making digital dollars travel around the world. The choice is more crystal clear than ever for businesses and individuals alike.