Non-Fungible Tokens (NFTs) were set to be the bridge between the blockchain and mainstream adoption in the early 2020s. It was like the world of great digital art, music and collectibles had opened up and closed to the mere millions in value and every other celebrity was opening his or her own NFT project. However, in August 2025, NFTs are associated more with scam, broken promises and a marketing fiasco than with mass adoption. In this article, we explore why NFTs never lived up to their mass adoption potential, what it means for the crypto space and the lessons learned. We will also compare this with good examples — e.g. Dogecoin and the USDT ecosystem on TRON (through which crypto actually reaches the real user).

NFT Hype: from Mania to Mistrust

Nobody has remotely heard of NFTs until they exploded in the mass public mind in 2021 and 2022. Digital artists, musicians, and even sports leagues sprang up to mint and sell their original digital tokens on Ethereum and TRON, among other blockchains. The pitch was pretty straight forward: through NFTs we would see the democratization of ownership, the liberation of creators, and digital assets being valued in the marketplace the same way that physical art is.

But this reality turned out to be far messier. The NFT market crashed by 2023. NFT trading volumes collapsed more than 60% from historic highs and the view on NFTs soured in the public eye. The word NFT in 2025 is just as likely as not to remind you of the latest innovation as it is of scams and rug pulls.

Why Did NFTs Not Go Mainstream

1. Linked with Scams and Spam Projects

The great NFT boom drew the attention not only of artists and collectors, but also that of scammers and other opportunists. It also became commonplace to hear of these really high-profile rug pulls — basically the projects would disappear with the investors' money. Waves of NFT projects came out with little beyond a JPEG and a vague promise of future utility. This led to a deluge of poor quality, low-value assets flooding the market, diluting it to a point where it became completely untrustworthy.

2. Celebrity Endorsements Backfired

NFTs were the hottest ticket in town, so brands and celebrities — from athletes to pop stars — spun around and tried to sell them pretty much right away. However, rather than lending credibility to NFTs, these endorsements more often than not had the opposite effect.

Most of the projects backed by celebrities were mismanaged, over-priced, or outright scams. The reputation of celebrities was not the only one due to suffer when these projects fell; the whole NFT space did as well. And to many in the press, NFTs were no longer seen as a tool of empowerment but instead as a rich-and-famous world for them to exploit fans.

3. Complexity and Poor User Experience

To the average person, purchasing an NFT was (and frequently still is) a technical nightmare. They were forced to establish crypto wallets, acquire ETH or TRX, contend with fluctuating and often exorbitant gas fees, and decipher a perplexing array of marketplaces. Despite the emergence of more friendly platforms, it continued to be an intimidating practice for most non-crypto natives.

4. Speculation Over Substance

Utility was not the driving factor behind the NFT boom, but speculation. Buyers were, generally speaking, not looking for something to play games with or use in a community or metaverse; they were trying to flip their NFTs for profit. The speculative bubble popped, and with it, the momentum in the market. Away from the noise, some projects offered a genuine utility.

5. Regulatory Uncertainty and Security Risks

The legal and security issues for NFTs It resulted in confusion on the issue of intellectual property rights, royalties and consumer protections due to the absence of direct regulation. Phishing, hacks — all that jazz; users getting jiggy and losing millions due to hacked wallets and counterfeit marketplaces.

Consequences: Word to the Wise

How the crazy seasonal NFT bust trickles down through the wannabe crypto space.

Betrayed Public Trust. NFTs became shorthand for short man get rich quick and celebrity cash grab. It has thus created hurdles for legitimate crypto projects in achieving mainstream acceptance.

High Regulatory Scrutinize. Abreast the coil of while of scams and consumer losses, authorities negatively customers, receive begun escort at NFT platforms and projects. That new caution is reflected in the SEC's changing view of digital assets in 2025.

The Market Moved to Utility. The NFT market is not dead, but it has matured. Over the past few months, the attention turned toward utility-centric NFTs—be it digital IDs, event tickets, and in-game items than just the presumably testable art. That said, some of the damage done to the "brand" of NFT remains.

What Not to Do (Lessons Learned)

The NFT saga presents some serious lessons for any would-be mass marketers of crypto:

Trust and Nothing but Trust. If you lose it, the path to recovery is difficult. Scams and bust projects became so common that they poisoned the well for everyone.

Star Power Is Not a Substitute for Real Value. Celebrity hype can bring eyeballs but it can not fix a product or business model which is fundamentally broken. If your product is too complicated for the average user to understand, mass adoption will never happen.

Speculation is Unsustainable. Markets based on hype and FOMO will ultimately collapse. True utility leads to true adoption.

Regulation is Coming. Any project that disregards legal and security risks do so at their own risk.

Dogecoin: the Meme That Worked

Unlike NFTs however, Dogecoin (DOGE) is the coming of age crypto story we never saw coming. Doge originally stood a joke, and never thought to outlive all those "serious" projects that keep emerging every year, and being, until 2025, one of the most exposed crypto in the world.

The Way Dogecoin Succeeded but NFTs Failed

Simplicity. Dogecoin is very simple to comprehend and utilize. No excessive onboarding, no need to understand smart contracts, gas fees, etc. It simply allows you to send and receive DOGE.

Hedging Terms - Community and culture. The Dogecoin community is notorious for being a lore and a lot of fun. Rather than devoting to opulence, DOGE acknowledged its ludicrousness to define a meme-centric society of tipping, charity, and binges.

Celebrity Promotions that Were Successful. Elon promoting DOGE is a win, but the community was there and doing well. Instead, Musk's tweets merely increased what was already present, rather than attempting to create hype from thin air.

Real-World Use. Merchants are beginning to accept DOGE and it is used to tip to raise funds for many things. The feasibility for everyday use comes from its low fees and fast transactions.

Thus, the story of Dogecoin reflects that mass adoption is not about marketing but culture, simplicity and real-world usefulness.

TRON USDT: Holds the True Foundation of Crypto Payment

If Dogecoin is the meme coin that made it, the USDT ecosystem on TRON is the unsung hero powering the global crypto economy. Today its share applied to all Tether (USDT) transfers exceeds 75% (4–5 million per day since August 2025, further 5–7 million transactions processed on TRON network daily only), TRON has established a backbone for stablecoin payments in the other part of the globe, such as Asia and emerging markets.

Why TRON USDT Has Been So Successful

One reason why TRON was designed this way was so that it would be able to provide low fees, high speed transactions: Why TRON? Well, Tron's architecture allows fast transactions at a very low cost compared to Ethereum or Bitcoin. Transfers on TRON are typically charged under $0.0003 for USDT and settle in seconds.

- Scalability. Capable of approximately 2,000 transactions per second, real-world usage is consistently around 5–9 million transactions a day

- Stable Infrastructure. TRON Delegated Proof-of-Stake (DPoS) - model with 27 super representatives provides both speed and security. More than half of the TRX in the market is currently staked, which helps the health of the network as well as reducing fluctuations

TRON is based on a dual-resource model: Bandwidth for basic transactions and Energy for smart contracts (e.g. USDT transfers) within the TRON Energy Ecosystem. As an example, a normal USDT transfer to a wallet that already has USDT uses around 65,000 Energy in 2025 (which needs 13.4 TRX if burning, or 2.6 TRX if renting Energy, at $0.31/TRX this is ~$0.81). If it's the first time to receive USDT for this recipient wallet, it'll take approximately 130,000 Energy (roughly 27 TRX if burning or 8.8 TRX if renting, roughly $2.73). 10,000 TRX will yield around 65,000 Energy each day (this is enough for one USDT transfer into a non-zero wallet each day). The vast majority of users and enterprises use energy rental platforms to bypass the need to freeze TRX, achieving cost reductions of up to 80%.

More friendly solutions – growing number of tools and wallets that ease resource management (BitHide, Netts) has already made TRON USDT transfers friendly even to a non-technical user.

The Numbers Don't Lie

There is over $75 billion USDT circulating on TRON, more than all other blockchains combined. More than 286M user accounts and 10B+ on-chain transactions. And after one-case the last one year, the increase is 167%, and TRX to stake for energy is 17,2 billion USD - it's up 129%. As a result of TRON becoming the de-facto network for stablecoin transfers around the world; prioritizing usefulness and low-cost payments over hype or speculation.

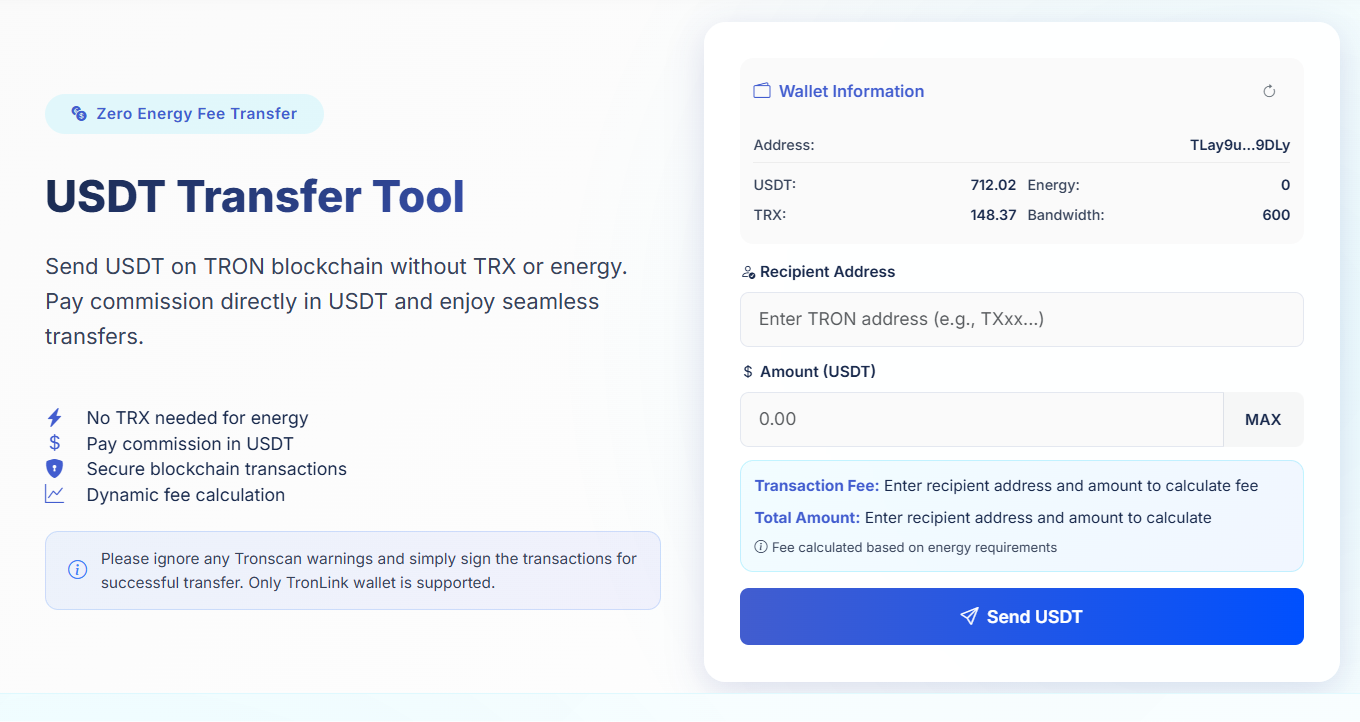

The Netts.io USDT Transfer Tool — Last Mile Solution

Even with TRON being a more efficient system, there was still a one major pain point: the user had to hold TRX to pay for the energy and bandwidth while sending, even if he/she was only sending USDT. That "energy wall" was a huge obstacle for new users and businesses.

Netts. io enables the USDT Transfer Tool to do the heavy lifting. Here's how it works:

Zero TRX requirement: users can directly pay transaction fees in USDT, no need to hold or manage TRX.

Connect with your TronLink wallet, set the recipient and amount, then sign a couple of transactions for an effortless experience. When Asset needs to use Energy, Netts assigns the needed Energy and publishes the transfer.

Real-time Fee Estimation: users only pay the required amount, and it adapts smoothly to the Dynamic Fee in real-time.

Business Integrations: to support recipient-paid fee models, Netts provides an API for businesses for fast and seamless crypto payments for exchanges, fintechs and for dApps.

This is the final barrier to USDT payment mass adoption on TRON. Netts.io takes making transfers as simple as sending a message. It is making the original dream of crypto a reality: payments for all, instant and cheap.

Beyond NFTs: the Future of On-Chain Art with TronMoji

Despite the history of NFTs being marred by a lack of utility and reputation, there is innovation in digital art and blockchain creativity within the TRON ecosystem. Among those new alternatives that has potential is the Netts Blockchain Art Studio and TronMoji Generator

TronMoji is a protocol where anyone can create 16x16 pixel art of their own and write them to the TRON block chain directly. Unlike "regular" NFTs which can be costly to mint and are usually referenced from external storage, TronMojis are:

- Indelible on-chain in the transaction memo field = complete censorship resistance

- Created and transferred at virtually no cost in relation to widely-used public chain stacks (roughly 1.1 TRX per inscription) due to the high efficiency of TRON Energy ecosystem and the possibility of renting Energy for an even lower cost

- Uncoupled – any viewer capable of reading the hex data structure for a TronMoji can easily find a way to build one out for display purposes

To create, simply choose the colours, paint your 16x16 grid, export the HEX code, and then claim your words personalised TronMoji to any TRON address. All of this is made possible by the protocol's technical design, which enables universal access and perpetual digital ownership while benefiting from the strengths of TRON's scalable and low-cost infrastructure.

This model of digital art — decentralized, immutable and open — exemplifies the way in which the TRON community both learns from the past and builds for the future. The Netts Blockchain Art Studio is changing the way we see things for artists and collectors with genuine usefulness, and low entry barriers and freedom of expression.

Final Thoughts: Real Use Cases Lead to Real Adoption

After all, first NFTs promised to bring the crypto out of the shadows but then just plunged into the hype of it and while for now it looks like just another scheme for getting profits on the complexity and distrust in the crypto itself. The simple community driven utility of Dogecoin or the USDT ecosystem powered by TRON offers the counterpoint. The rise of tools like Netts. And what it means basically is that the future of crypto adoption is not through the celebrity endorser, not the speculative hedge fund scheme, but the solution to real problems and real creativity, which is exactly what io and the innovative TronMoji protocol show. Moving forward, the takeaway is simple: mass adoption is deserved not inserted.