The history of money is the history of human civilization. Since the most ancient days when humans first formed communities, the demand for a trusted exchange tool has inspired creativity, developed communities and changed our mindsets towards what we define as valuable. It is now August 2025 and there are more cryptocurrencies and blockchain technologies ever as we enter one of the biggest monetary revolutions that mankind has ever known, perhaps next to the first implementation of paper money more than a millennium ago.

History of Trade: Barter and the Double Coincidence Problem

Before money appeared, humans relied on barter or direct exchange of goods and services. For example, a farmer could give wheat in exchange for tools from a blacksmith, or a hunter could give meat in exchange for clothes. Economists refer to the double coincidence of wants problem, which barter suffered from, as a barrier to effective trade between small communities. That required both sides to want precisely what the other had; trade was exceptionally inefficient and varied economic development.

This very basic shortcoming is reminiscent of early days of crypto adoption. For example, back in 2009 when Bitcoin was released, it was almost impossible to find someone who will accept it as a payment. Consider the first known Bitcoin transaction: 10,000 BTC for two pizzas in 2010. That transaction today would be worth more than $1.2 billion, emphasizing the growth potential as well as volatility of digital currencies.

The Origin of Money: Transition from Shell to Metal

When societies became more complex, people utilised commodities with inherent value as money. Around the year of 1200 BC, shells of the cowrie were used in China and later in Africa as an early example of commodity money. The shells were light, tough, portable and impossible to fake — features that would make up the perfect currency and money.

Moving over to metal was a huge step forward. China started using bronze and copper for metallic cowries around 1000 BC and the first standardized coins were issued by the Lydians (in what is now Turkey) around 600 BC. These coins of electrum (a natural gold-silver alloy) represented the first true concept of a revolutionary idea of measurable and verifiable value standardized across the entire kingdom.

The similarity to cryptocurrency is incredible. As precious metals solved the issues of barter by providing a universal medium of exchange, cryptocurrencies solve the issues of fiat money by providing decentralization, transparency and resistance against inflation. But the number of bitcoins in circulation are limited — 21 million coins — so the supply aspect has similarities with precious metals, and it is underpinned by blockchain technology, which can be verified and secured in a way that a coin made out of metal cannot.

Paper Revolution: Its Journey from Promises to Fiat

Another significant development, and typically Chinese innovation, was the introduction of paper money in 7th century by the Tang Dynasty. At first, traders would deposit coins with someone they trusted and received a certificate they could present elsewhere. Those certificates, in turn, were later used as money themselves, from which the present-day banking structure has slowly emerged.

Over many centuries we have gradually transitioned from money linked to physical goods through commodity-backed money to pure fiat currency. The US dollar was supported by gold until 1971, when President Nixon cancelled the gold standard. This change gave unprecedented control to governments over monetary policy, but also excessive rights, the risk of inflation and devaluation of currency.

These risks partly led to the emergence of cryptocurrencies. Bitcoin was born in 2009 — right around the time that faith in traditional financial institutions was at an all-time low during the global financial crisis. And this cryptocurrency provided an escape hatch: money that could not be inflated, money that could not be seized, and money that was free from the clutches of any state or central bank.

Digital Age: from Electronic Banking to Cryptocurrency

In the late 20th century, banks began electronic banking and digital payments, leading the way for the crypto currency revolution. The first step was placing money on cards, which started happening in the 1950s. Taken until the 1990s, we saw the emergence of online banking and digital transfers, but these were still limited to fiat, centralized currencies.

What happened after the invention of Bitcoin in 2009 was the genesis of a new paradigm. Unlike electronic fiat money, which is merely a digital copy of government-backed money, cryptocurrencies are indigenous digital assets with unique characteristics of their own. These new forms of money build on the programmability of software, combined with the scarcity that precious metals can deliver, creating completely new systems for transmitting value between humans.

TRON - Evolution of a New Digital Money Experience

Among the thousands of cryptos that have sprung from the original Bitcoin TRON (TRX) is a most interesting evolution. Established by Justin Sun in 2017, TRON has shifted from a controversial ETH competitor to one of the most utilized blockchains in the world — with 5-7 million transactions processed every day.

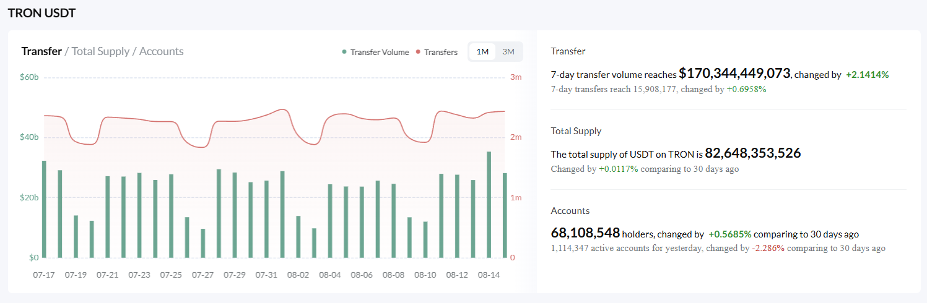

While also not totally disconnected from speculation, TRON is successful because of a focus on real world utility. As one of the most crucial infrastructures of the digital economy, the network supports over 75% of all globally transferred USDT stablecoins. This pragmatic methodology reflects the trajectory of winning historical currencies, which broke-through not from advertising or hype, but from the actual need for real users to address problems they faced.

With the unique resource model of the network — TRON Energy and Bandwidth instead of gas — new possibilities for innovation have emerged. This, in turn, allows users the option of either staking TRX to produce Energy or renting it from Energy providers, resulting in an extremely complex ecosystem of Energy rental service which minimizes transaction fees.

Energy Economy: New Era of Digital Assets

TRON's Energy system displays an interesting transformation of the way digital resources are governed. TRON's Energy market is unique in the sense that the cost of transactions is determined by decentralized supply and demand dynamics, unlike traditional currencies where the cost of transactions is decided by centralized authority.

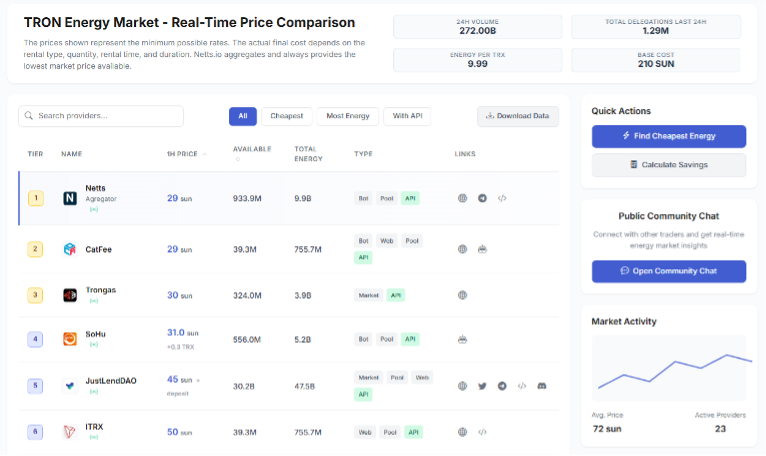

With more than 1.35 million daily delegations processed, the current TRON Energy market has captured a total volume of more than 284 billion energy units over the past 24 hours. Around this magnitude, we see how the network advanced from being a simple cryptocurrency to an advanced economic ecosystem with markets and price discovery on its own.

Average energy price among all providers is now around 72 SUN/unit, with best providers regularly providing rates less than +/- 50 SUN. This market structure allows the network to always be able to find the least cost way for a user to obtain resources on the network, similar to how markets for commodities have always led to effective price discovery for physical goods.

TRON Energy Market: Optimization Aggregator

At the heart of this network, the TRON Energy Market is the recent advanced step — an aggregator for Energy renting that offers real-time price comparison between all available Energy providers. The marketplace combines more than 23 different energy providers who are competing towards providing the best rates and service against each other for users.

Numbers speak volumes of adoption and efficiency in the market. The platform is now an integral part of the TRON ecosystem, boasting over 21 billion Energy units delegated and exceeding 10,000 TRX paid to referrers. With 99.9% uptime guarantee and 24/7 customer support the system provides reliability essential for businesses to run their operations.

For example, right now Netts, CatFee, and Trongas are competing for price at top 3, starting at only 29 SUN for 1 energy unit. The undeniable competitive environment makes sure users can always use the cheapest way to do whatever they want like simple USDT transfers, or complex smart contract interactions.

Parallel History: Marketplaces to Digital Aggregators

The evolution of the TRON Energy Market into a one-stop solution for Energy renting acts as a similar trajectory found within traditional financial markets. Medieval traders would gather in the same marketplace to compare prices of goods, and modern crypto users only recently have aggregated marketplaces available that offer real-time price comparison and automatic routing to the least expensive provider.

This evolution is a logical step in the growth stages of cryptocurrency markets. Just as early traders had to trek to the local marketplace to price shop, early crypto users would have to compare prices by hand across exchanges and services. Now, these aggregators automate this process and help you find the best available rates from multiple providers instantly.

Its API integration capabilities allow developers to create automated systems enabling users to automatically choose the cheapest energy provider for every transaction. Such level of automation and efficiency was unimaginable in traditional financial markets until very recently; showing how far ahead the cryptocurrency technology is compared to legacy systems.

History as a Teacher for the Future of Money

The historical precedents have a lot to say too about what we can expect for the future of money. All major changes in money—commodity money, paper money, electronic money—once faced the egg of disbelief and occasional hostility. But each of them in turn ultimately became a vital infrastructure component for economic progress and human development.

It seems that cryptocurrencies are headed down the same road. Yes, early adopters went through considerable pains to be accepted and prove their use cases, but this technology has matured into offering real solutions for real users. The fact that TRON is now the go-to platform for USDT transfers shows how cryptocurrencies can move beyond speculation to actual use.

The appearance of mature markets such as the TRON Energy Market proves the maturation of crypto ecosystems. Similar to how the traditional financial markets developed increasingly complex instruments and services to cater to the requirements of the different users of its markets, the crypto markets are maturing to provide the tools and services which are necessary for mass adoption.

Conclusion: Evolution Continues

Monetary history has shown us that monetary systems adapt to the maturity of its users — their needs and tools. Each innovation, from barter to precious metals to paper currency to digital money, has broaden our potential for human economic activity.

Cryptocurrency is simply the latest chapter in this evolutionary turning. They merge precious metals scarcity with software programmability, enabling new types of money and value transfers. The TRON network optimizes its ecosystem for practical use cases and better resource allocation, providing a model of what these new potentials look like in practice.

Thus far, we have explored an example — the TRON Energy Market, which acts as an aggregator for Energy renting — that demonstrates this process of improving system competitiveness through development paths that aggressive cryptocurrency ecosystems can take on deeply interrelated technological and social domains to create more sophisticated market structures than traditional financial markets whilst simultaneously challenging deep institutional norms about market accessibility and efficiency itself. This evolution indicates that cryptocurrencies are not just the next fad, but better primitives for a new mental model of money.

Now into the latter half of 2025, the crypto space displays unprecedented maturity and institutional adoption. With technological innovation, and regulatory clarity, and real-world utility, we're witnessing what the beginning of a monetary revolution that will fundamentally change the world economy in ways we can barely imagine.

It's been a painful, centuries-long evolution from barter to cryptocurrency, but the finish line is coming into sharper focus: a modern financial system capable of delivering digital sophistication to user needs in a dynamic, efficient, accessible and inclusive manner across the planet. From direct engagement in cryptocurrency markets to utilizing next-generation services such as the TRON Energy Market, this transformation now involves new levels of opportunity for both individuals and businesses alike.

Money is always evolving, and crypto is the latest (and arguably most disruptive) chapter in that story. History is a teacher though, and many, who, as predicted, will find themselves among the 3rd class of economical opportunists are those exchanging their life savings for pasta while the monetary reset is omnipresent. Cryptocurrency technology has tools to ensure that the future of money is been written today, and that it is written in a way that benefits all.