Out of a wish for an appropriately functioning financial system, free from the central bank policies and issues of the state, cryptocurrencies emerged. However, with the maturation of the digital asset market, traditional monetary authorities such as the U.S. Federal Reserve have become ubiquitous. The relationship between central bank policy and the crypto ecosystem, from Bitcoin to stablecoins, and from Ethereum to the TRON Energy ecosystem, has never been more complex than it is in 2025. Here, we discuss how the decisions of the Federal Reserve, in concert with other major central banks, is still shaping the crypto landscape, and how users and investors, particularly those operating on networks like TRON, can interpret these signals in order to predict market direction.

How the Crypto Era Will Change the Federal Reserve

Returning to a raging bull, any serious detached conversation about an impending slump can only begin after the initial rate hike or two from the Federal Reserve (Fed), the most powerful central bank in the world and the one that sets the course for rest for global interest rates, liquidity and risk appetite. The impact of its policies — from tightening and cutting rates, to QE and QT — has always rippled through conventional markets.

How Fed Policy Affects Crypto

This is how the interest rates and liquidity factors play into it: the Fed hikes from time to time, which makes debt pricier, leads to outflows from risk assets (which has seen crypto behave like every other risk asset) and helps the dollar rally. On the other hand, rate cuts and QE add liquidity and make other assets, especially speculative assets, more attractive. Between 2024–2025, the Fed's more cautious balancing act – countering inflation and growth – has brought both tightening and easing and driven crypto volatility each time.

Dollar Dominance and Stablecoins

While the U.S. dollar being the de facto global reserve currency, practically all stablecoins (USDT, USDC, etc.) are pegged to it. As a result, when the Fed are making dollars stronger, stablecoin demand stabilizes in situations where that is local currency devaluation like emerging markets. But at the same time, the dollar is a safe haven, which can make crypto less attractive as a hedge, while a weaker dollar can push in the direction of capital to Bitcoin and other cryptocurrencies as other forms of capital.

Monetary Policy and Regulation

The Fed is the mood setter for global risk, depending if its tone is hawkish or dovish. The U.S. government is no longer trying to take down crypto but is taking it, but the new regulatory light is not enhancing behavior in the light at the same time as the Fed warnings about systemic risk and financial stability are still present in how investors behave in 2025. Markets often play so close to the Fed when it sounds alarms on asset bubbles or crypto leverage.

Theory and Testable Predictions: Fed Moves and the Crypto Responds

The latest research (2025) indicates that more than volatile cryptocurrencies such as Bitcoin and Ethereum usually respond favorably to Fed easing; the dollar pegs of stablecoins can face adverse impacts if policy moves fast enough to test them. For example, Bitcoin initially enjoyed a de facto reprieve when the Fed paused rate hikes (early 2025) even as Tether (USDT) experienced short-lived de-pegging episodes as Treasury yields gyrated. Moral of the story: crypto is not shielded from central bank policy — it is, if anything, now more attached to the global liquidity cycles.

Worldwide Context: Different Central Banks and Crypto

The Fed is in charge but other central banks are important too. The rates and policies of the European Central Bank (ECB), Bank of Japan (BoJ), People's Bank of China (PBoC) and Bank of England (BoE) help determine how cheap or expensive the capital is globally. There are a few trends that are noteworthy in the year 2025.

ECB. The euro became more desirable due to ECB normalization of rates, but at the same time made euro-pegged stablecoins more volatile. The ECB policy statement is always watched closely by European crypto users for borrowing costs and DeFi yield expectations.

BoJ. Japan has kept itself in its ultra-low rate environment, creating a weak yen, and pushing Japanese investors into US dollar stablecoins as well as crypto assets as a hedge against declines in a currency that continues to weaken against the dollar.

PBoC. China's digital yuan pilot expanded but capital controls are highly restrictive Finally, as a large chunk of TRON network activity is driven on the entrance and exit of value into China via Chinese users using stable coins such as USDT, PBoC policy is a large variable for TRON.

Emerging Markets. Where local currency volatility is spurring adoption of dollar stablecoins and crypto remittances, making central banks in Latin America, Africa and Southeast Asia increasingly pertinent parts of the conversation.

Mapping Out Crypto —Things to Look Out For

If we want to clarify the second part and be able to predict where the crypto market is heading — especially with networks such as TRON — we must take into account at least six indicators:

Banking Rates and Guidance

Crypto markets can be moved by every Fed meeting, ECB press conference, or BoJ policy tweak. Both traders and developers pay close attention to clues concerning soon-to-be policy directions, given that every dollar of capital is subject to what would eventually trickle down to them as DeFi lending rates and startup funding costs among other things.

Stablecoin Flows and On-Chain Data

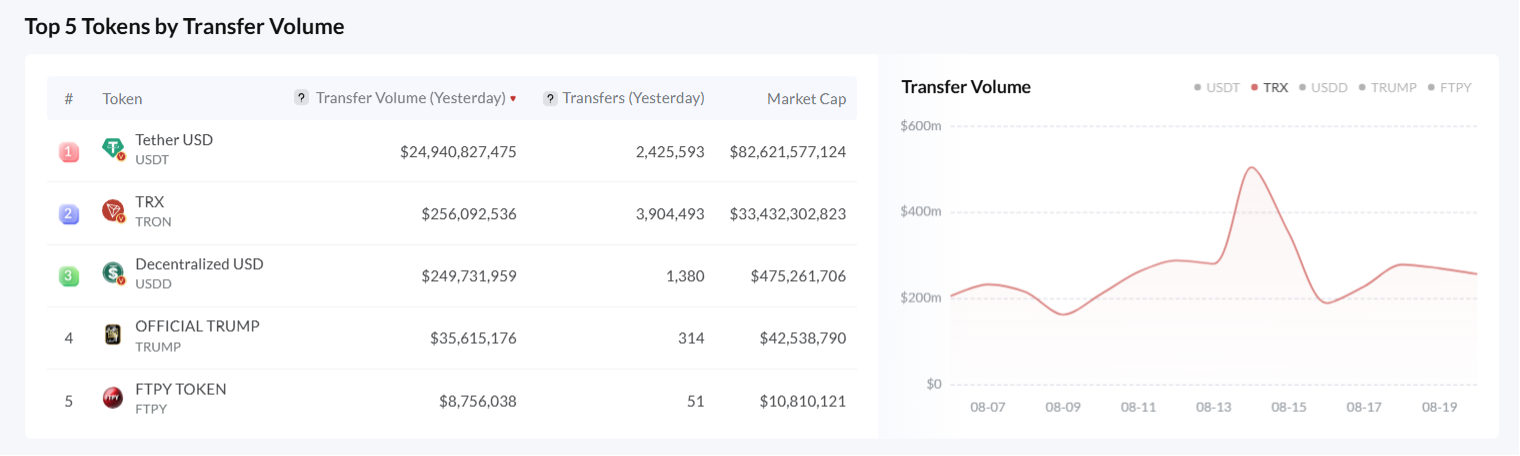

Stablecoins are the very soul of crypto trading and DeFi. Over 85% of USDT transactions are done on TRON, making it an indicator of the global appeal of digital dollars — in 2025 Changes of USDT issuance and redemptions are usually before very big move in the market, and TRON Network activity spike typically sign of global liquidity changes.

TRON Energy Ecosystem Metrics

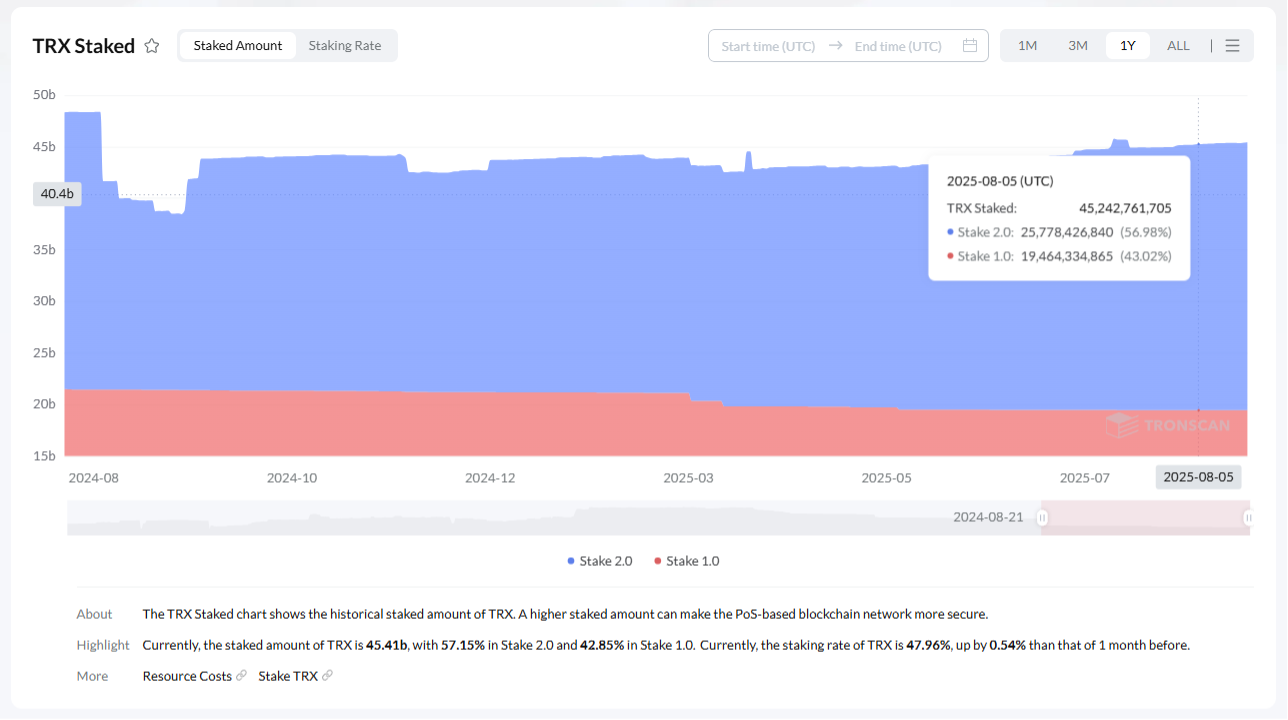

A special element of the network is the TRON Energy ecosystem that enables users to stake their TRX or rent TRON Energy for the purposes of transaction and smart contract fees recovery. Almost all TRX will be staked around August 2025, while 17.2 billion TRX are committed to energy — up 129% year-on-year. The free will that drives this surge is the largest USDT transactions, responsible for 95% of global energy consumption on TRON. With network activity soaring beyond 8 million transactions per day, the recent TRON Energy renting has been the first cost-saving strategy for many retail users and dApp developers.

Bandwidth and Energy Requirements

TRON has a resource model in which users need to constantly manage their bandwidth (for simple transfers) and energy (when executing smart contracts). TRON has remained the backbone for stablecoin transfers and DeFi, and subsequently energy usage on TRON has increased 167% and bandwidth 50% through 2025. To illustrate, a simple USDT transaction costs around 1,500–2,100 energy, while a more complicated smart contract interaction can cost significantly more. With energy now being rented or delegated and large amounts of TRX not needing to be staked, the network has been opened up to the masses and everyday users have benefited from lower costs.

That is, if the central bank sack of tools helps provide a lift for crypto in some situations then it likely doesn't in others. Below is a succinct summary of the key impacts:

Positive:

- When the Fed eases (rate cuts, QE), liquidity flows in which often pushes crypto prices up

- Clarity of regulation (read: the U.S. in 2025) promotes institutional adoption and innovation

- Instability or inflation globally could drive users toward stablecoins and crypto as a hedge

- Cheap rates across the globe (Japan, EU) push capital into high-yielding DeFi protocols and attracts institutional interest

Negative:

- In this case, Fed basically tightening (rate hikes, QT) can induce outflows from risk assets — by default, crypto too

- A dollar that becomes stronger makes Bitcoin and altcoins less attractive as complementary stores-of-value

- It may also quickly stifle innovation and reduce liquidity with regulatory crackdowns or uncertainty (some countries)

- We saw with Tether that rapid moves in rates create instability with stablecoin pegs, particularly during volatile Treasury markets

Case Study: Reading the Signs (TRON)

The unfolding of TRON in 2025 represents a microcosm of global monetary policy and the intersection of innovation and crypto:

Majority of Stablecoins

With more than half of the $55 billion USDT existing on TRON and representing 85% of total USDT transactions on the network TRON has become the main rail for the digital dollar flow. It is therefore very responsive to changes in Fed policy (i.e., changes in dollar demand or Treasury yields results in changes in network activity).

With TRON Energy renting gaining popularity and the automatic growth of TRON Energy ecosystem, efficient resource management has become an important part of user strategy. Network congestion and energy prices ebb and flow with global liquidity, requiring users to evolve alongside them, just as traders in the rest of the central bank universe do.

Expansion of DeFi and dApps

TRON is seeing impressive growth in DeFi, with the TRON DeFi TVL (total value locked) gradually increasing as billions of TRX are deposited into protocols including JustLend and SunSwap. Returns on these platforms tend to correlate with global interest rates, so they tend to price in central bank policy changes.

Governance & Staking

Governance decisions (like protocol upgrades or fee changes) are playing an outsized role as almost half of all TRX are staked. Responses to external factors, including regulatory developments and macroeconomic trends, often influence these decisions.

International Comparison: Other Central Banks and Crypto Policy

So, while the Fed is driving the car, the rest of the central banks are not just sitting there. The ECB digital euro project, the continuation of monetary easing in the case of the BoJ, and the digital yuan by the PBoC all testify that central banks have accepted that digital assets are here to stay. While CBDCs are being tested in some areas and pushed in others, stablecoins and DeFi are facing increased scrutiny and regulation across the globe. This means that for TRON users, global policy changes can have an impact ranging from the cost of transactions to the on and off ramps to fiat.

Looking to the Future: How to Predict the Make-up of Crypto

So, for users and investors alike, the trick is to remain dynamically in the know. Here are a few strategies:

Be aware of central bank statements and data releases. These periods often come before major moves in both traditional and crypto markets.

Monitor stablecoin flows and on-chain metrics, particularly on TRON. Plummets in USDT issuance or redemptions characteristically indicate shifts in global liquidity.

Keep an eye on TRON energy and bandwidth prices Costs going up suggest that more users are doing transactions on-chain, which means more congestion (or higher demand) on the network, and vice versa for costs going down – indicating that transactions on-chain are not high or the proficiency of the network increased.

Stay updated on regulatory developments. Updated: Oct. 31, 2023 8:00 am ET Crypto's share of international flows will rise over the next two years as the U.S. becomes more crypto-friendly in 2025 and other regions tighten or ease rules.

Exploring the Netts Ecosystem: Maximising TRON Energy with Changing World

With the growth of the TRON network, there has also been an increased demand for efficient resource management. Enter Netts: the first energy rental aggregator on TRON, which gives you access to billions of energy units from trustworthy providers, all at the lowest market price. If they want to rent TRON Energy to transfer USDT or do other things, Netts gives a perfect, economical solution with 0 staking, 0 freezing, and 0 delivery time (within seconds).

Netts saves users up to five times less than burning TRX and over three times less than staking, all while providing API access, Telegram bot integration, and automated energy management. Real-time balance monitoring, competitive pricing and round-the-clock support make it a suitable partner for retail and enterprise users alike. With the backdrop of central bank policy, global liquidity and innovation driving the continuing evolution of the crypto landscape, tools such as netts.io will have a critical role to play in managing cost efficiencies and providing competitive advantage in a high velocity digital finance environment.

Conclusion

Adversarial nature of the Fed, other central banks and the Crypto ecosystem Crypto was born as an asset that should exist outside of traditional finance, yet the world of crypto has become deeply attached to global monetary policy. For networks such as TRON, which are founded on these forces, this is an essential wield. Using his new strategies through central bank action monitoring, on-chain data tracking, and tools like Netts to optimize resources; users can find their way through the opportunity — and obstacles — of this new financial era. the means to pursue their own dreams.