From the very beginning, the cryptocurrency market has played host to the greatest extremes, where fortunes can be created in hours and lost just as quickly. Since the mysterious birth of Bitcoin in 2009, digital assets have grown from a niche experiment to a multi-trillion dollar ecosystem that threatens the very foundations of finance. August 2025, and the market is still volatile as always, yet it somehow seems more mature and institutional than ever before. Would crypto by any chance be more stable in case some of these cryptocurrencies had such a long established historical background?

The Early Days: Bitcoin's Volatile Journey

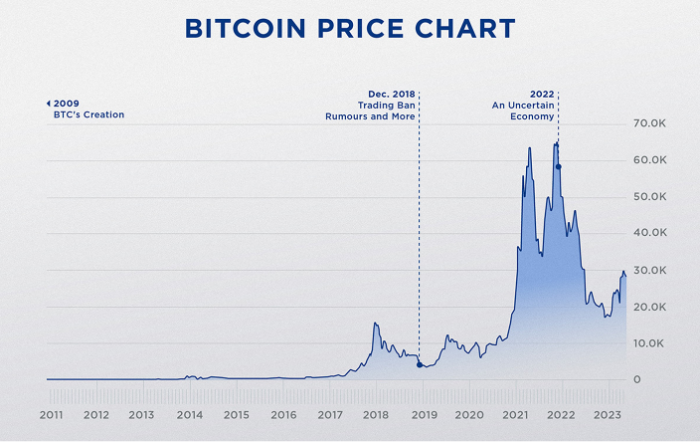

The saga of volatility in cryptocurrency starts with the early days of Bitcoin. The first known Bitcoin transaction was for two pizzas in 2010 for 10,000 BTC, which would be $1.2 billion at Bitcoin's peak in 2025. This early case summarizes the extraordinary price volatility that would later characterize the crypto market.

The timeline of Bitcoin rising from under a cent to more than $123,000 in July 2025 is an incredible wealth creation story for the ages. But this climb was not at all a straight line. There were a series of boom-and-bust cycles with the cryptocurrency gradually becoming more intense over time. For example, back in 2013 Bitcoin rocketed from $13 to $1,100 then collapsed to $200. It broke to around $20,000 in the 2017 bull run, then fell 80% during the 2018-2019 crypto winter.

The cycle of 2021 was the most painful one though, bitcoin hit $69,000 before crashing down to $16,000 in 2022. And this volatility was not restricted to Bitcoin; the entire crypto market behaved in a similar fashion: altcoins frequently displayed much more volatile swings. Ethereum, for example, dropped 81% from $4,800 in November 2021 to below $900 in June 2022.

Fear And Greed Index: Indicators of Market Emotion

Crypto Fear and Greed Index compiles several indicators of the market (volatility, market momentum, social media sentiment, dominance, trends) to create a score that may range from 0 (Extreme Fear) to 100 (Extreme Greed).

The index has been relatively stable over the past few years in 2025, typically sitting within a range of 40-70, signaling a more mature market. That said, there are significant jumps. When the price of Bitcoin peaked at $123,000 in July, the index surged to 85 where extreme greed was noted. On the other hand, in March of 2025 when Bitcoin corrected to $98,000 the index dropped as low as 25, suggesting extreme fear.

As of August 16, 2025, the index is showing a value of 65, which indicates a position of cautious optimism in the market. That moderate level shows investors are confident but not so much so that you have the usual bubble blow-off from market participants preceding large corrections and large cyclical bear markets.

The Winners: Tales of Moonshots

These stories are some of the most extraordinary wealth stories of our time, all made overnight by the cryptocurrency market. Bitcoin has created thousands of x returns for the people who have held their coins through multiple cycles, starting to buy decades ago. In 2013, the Winklevoss twins famously bought $11 million worth of Bitcoin, which grew to be valued at over $1 Billion in 2025.

The co-founder of Ethereum, Vitalik Buterin, was gifted 315,000 ETH at the launch of the network, which has increased in value from nearly zero to approximately $1.2 billion at current prices. Likewise, TRON founder Justin Sun has capitalized on his TRON ecosystem and a number of crypto investments to the tune of more than $2 billion.

The greatest success stories are those that come from nowhere. The tale of the Norwegian fellow who bought $27 of Bitcoin back in 2009, and forgot all about it for four years until he remembered to check his wallet in 2013, only to find the miniscule investment worth $886,000 (and instantly converted it all to US dollars at the top of the 2013–2014 bubble) If you invested that money in 2025 it would come to more than $15ml.

The Losers: Lessons Lost on Billions

Alongside every success story are innumerable stories of ruin. The volatility of the cryptocurrency market has also brought down countless, from individuals to organizations. FTX collapse punch millions of users across the globe, lost over $8 billion in 2022. In May 2022, the crash of the Terra/Luna ecosystem saw more than $40 billion of market value evaporate within days.

Individual investors have not escaped such dramatic losses as well. Thousands who purchased Bitcoin during the 2021 top of $69,000 watched 70% of their investment fade away on the 2022 bear market. The fate of those who bought altcoins during the bull run of 2021 was typically far worse, with many such tokens suffering a loss of 90 per cent or more.

These losses take a psychological toll that cannot be overstated. There are plenty of stories of investors who sold their homes or drained their life savings to purchase crypto at market peaks, only to watch those dreams of financial independence disappear in weeks or months. This emotional rollercoaster of seeing substantial wealth rise and fall has created what some psychologists have termed "crypto trauma".

Traditional Investors: Overcoming Skepticism and Adopting Strategically

Traditional investors have responded to cryptocurrency in an entirely different manner over the last ten years. At first, the cryptocurrency landscape was met with intense resistance from Wall Street, with people like Warren Buffett memorably dubbing Bitcoin "rat poison squared" and Jamie Dimon branding it a "fraud."

But the landscape shifted significantly in 2020–2021 when big institutions began to pay attention. It was around the same time Bitcoin-accruing companies such as MicroStrategy, led by Michael Saylor, started treating Bitcoin like a treasury asset, which led to MicroStrategy gathering over 214,000 BTC valued over $25 billion today.

But it wasn't until 2024-2025 that the truly game-changing moment arrived in the form of spot Bitcoin ETF approvals. Fundamentally, the market structure has been altered with more than $158 billion in assets under management flowing into BlackRock's IBIT and Fidelity's FBTC. So-called Bitcoin ETFs have brought the coin to traditional investors who otherwise couldn't or wouldn't wade through the crypto exchanges.

This has both been good and bad for the entire world of cryptocurrency and blockchain technology through the lens of institutional adoption. The bright side is how it has offered a liquidity and volatility mitigation. The downside being that it has made the market more correlated to traditional financial markets and thus as a result, reducing some of the diversification benefits of crypto.

TRON: An Exemplary Model of Evolution and Next-Level Resilience

TRON (TRX) is one of the most interesting case studies of all the thousands of cryptocurrencies that have sprung up since the establishment of bitcoin. TRON, which became infamous in 2017 as a questionable Ethereum competitor cofounded by Justin Sun, has since grown into one of the most user-friendly and functional blockchains on the planet.

TRON has never been an easy journey, though controversial and innovative. The network came under fire for alleged plagiarism and technical shortcomings during its initial launch. But in the years following, TRON has established a flourishing ecosystem that handles more than 5-7 million transactions every day and is responsible for more than 75% of all USDT stablecoin transfers globally, prompting critics to eat their words.

A handful of factors can be accredited for the success of the network. On the one hand, TRON, with its emphasis on high throughput, and low transaction costs, is more appealing to application scenarios. Third, the network's innovative resource model that employs Bandwidth and Energy in place of regular gas has paved the way for services such as Tron energy renting to emerge.

As the TRON network continues to develop and many users need to conduct transactions on it, how to obtain Tron energy has been a necessity for many. The network needs Energy to interact with smart contracts, and users can either stake TRX to earn Energy or buy it from providers dedicated for that purpose. As a result, a highly developed eco-system of energy rental services has emerged to help customers minimize their transaction costs.

Technical Infrastructure: Managing Energy and Bandwidth

The resource model of TRON is one of its most unique characteristics. Ethereum has a simple way to measure all costs involved in a transactions and that is using a gas fee system, however, TRON has different resource usage measurement by employing a dual-resource model where it consume either Bandwidth or Energy when executing transactions. Bandwidth is used for simple TRX transfers, while Energy is required for smart contract interaction.

Such a system has thrown up challenges but it has also opened up new doors. It is important that users know how to get energy easily on Tron — The cost of Energy usually varies a lot depending on how much the network is being used. Energy prices can skyrocket during epochs of high activity, and such transactions become costly for users, if they are not ready.

The Energy rental market has been introduced to solve this problem. Platforms have also built complex systems that enable users to rent Energy on demand, often at a fraction of the cost of renting or staking TRX directly. It has provided a service that is especially useful for businesses/high-volume users who want to know in advance what their transaction costs will be.

Signs of Maturity and Hope: Future of Cryptocurrency

Here are some good reasons why the future of cryptocurrency looks bright, even in the face of recent turmoil and uncertainty. The outstanding bursts of the marketplace to rebound using some very big traces to new all-time highs. This type of institutional adoption we are experiencing in 2025 is a paradigm shift of traditional finance view on digital assets.

Regulatory clarity is improving globally. The United States has the GENIUS Act covering stablecoins, and the CLARITY Act classifying Bitcoin and Ethereum. Abstract MiCA framework combines a wide range of possibilities for better cryptomarket regulation in the EU. These developments are making the market more appealing to institutional investors, which will help to reduce uncertainty.

At a very fast pace, technological innovation continues. Scaling solutions are increasingly being adopted with Layer 2, consensus mechanisms are being adopted that are less damaging to the environment and UX is improving, making it easier than ever for mainstream users to use crypto.

Netts.io Revolution: Enhancing the Energy Economy of TRON

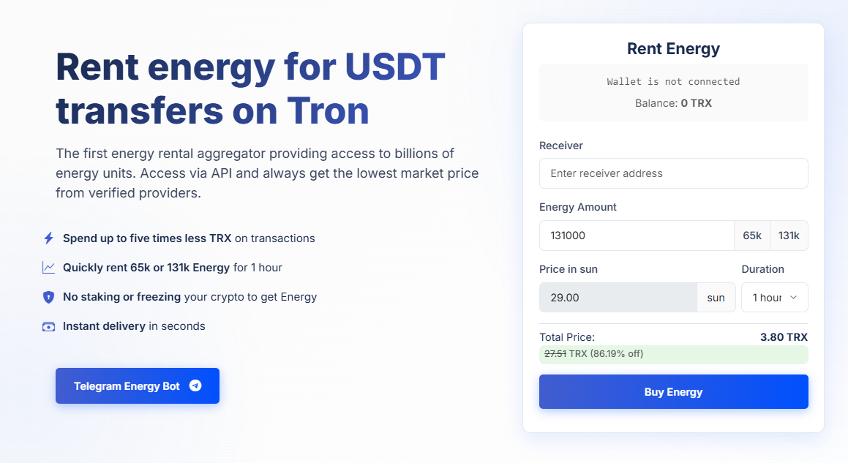

With the boom of TRON also some innovative solutions are coming in play to tackle the Energy management issues. Netts.io is another step forward for this space, this is the first ever aggregator for renting Energy, with access to billions of energy units coming from verified providers.

It innovates the way for renting Tron Energy on the platform. Netts.io enables transactions without the need for users to stake significant TRX or burn tokens. Users on io can rent the Energy they need, on demand — no more and no less. Compared with burning TRX and using traditional staking methods, this system can cut transaction costs by up to five times and three times respectively.

Netts.io statistics from the platform tell a very interesting story about adoption and leveraging efficiency. It has become a basic infrastructure of the TRON ecosystem, with over 21 billion Energy delegated and over 10,000 TRX paid to referrers. The 99.9% uptime pledge and then 24/7 customer support therein provide the reliability businesses need.

The ecosystem provides a web interface and a Telegram bot to use the platform, which is suitable for users of all technical levels. Add to that the Telegram bot that allows a 10 TRX minimum deposit and gives you the chance to free up Energy altogether during hours when demand is low and the environment is quite innovative.

For developers and businesses, Netts.io offers automated Energy management with API access. This is especially useful for apps that require high throughput for transactional processing. Thanks to the competitive pricing model of the platform and its instant delivery, it has become a great choice for individual users, as well as enterprise clients.

Conclusion: An Evolving Market

2025 is a whole different world to 2015 and 2020s crypto. Even though volatility continues to be a prominent feature, a lot has changed and matured in the market. However, the landscape has matured, and now institutional adoption, regulatory clarity, and technological innovation creates the foundation for sustained long-term growth.

These success stories and cautionary tales are externalities, but reminders of the market's twin nature. For every investor who has made a life-changing profit, there are many more who have lost a small fortune. Which places even greater emphasis on education, risk management, and a long-term view.

The transformation of TRON from dubious startup to dominant financial infrastructure provider speaks to the capacity of blockchain technology to deliver true utility. The practicality of the network's focus, coupled with growing solutions such as netts.io demonstrates the way in which the ecosystem will be able to change in response to real-world requirements.

Looking ahead, the future of cryptocurrency seems to be set for growth and further development. Institutional adoption, regulatory clarity, and technological innovation are just some of the factors that could indicate that we are moving into a new level of crypto maturity. Although volatility will probably be a part of the market, the fundamentals are in better shape than ever.

The trick to making it in this changing business climate is realizing that crypto is more than just speculation, it is the basis for a brand new monetary system. By investing directly, encouraged by DeFi protocols or by using services like Netts.io to minimize transaction costs, there are endless avenues to join this change.

In spite of the ups and downs of digital currency, the ride might not stop soon, but the end seems more agreeable — a much-effective, low-cost, all-inclusive financial regime with an adequate resource supply meeting various user demands throughout the globe. While this is a painful lesson for some, for those who approach the ebbs and flows patiently and informed, the opportunity is still large and the ability to do good is larger than ever.