By 2025, the political economy of cryptocurrency was not fiction but fact: governments legislate, regulators enforce and blockchains react instantaneously. The decade of vagueness that characterized crypto is quickly being replaced by a form of plumbed compromise between code and law. TRON is sitting at the crossroad of this global tectonic shift and has created a titan of public blockchain infrastructure. Home to the largest circulating supply of USD Tether (USDT), the predominant global stablecoin by far, it has become a primary railroad for cross-border value transfer. However, its success has also positioned it squarely under the microscopes of regulators. They examine the new rules being set in the largest markets globally, while sanctions and law enforcement actions are testing the extent that public chains can credibly effectively police illicit finance at scale. Last few decades ago, it was predicted that it has been a time of consumers, by early 2025: however, by August 2025, this article is shaping the current political and business landscape for crypto, particularly as it relates to the TRON network. It explores the tectonic changes in regulation from Washington to Hong Kong, on-chain enforcement actions re-shaping risk and market structure shifts challenging existing players. It also serves as an authoritative overview of how the resource economy powered by TRON works today, providing actual use cases for consumers and enterprises alike and clues to navigate the complexity of this new environment.The Global Touchstone: Enforcement to Normalisation The crypto industry has been shrouded in regulatory uncertainty for years. Now, in 2025, this uncertainty is finally starting to disperse – not with a single, sweeping pronouncement, but a series of well-coordinated, framework-oriented actions by world economic superpowers. The emerging consensus is not a continuation of the same posture toward purely reactive, enforcement-led policy that has prevailed in the past. Instead, the goal is to establish a clear set of laws that will comprehensively manage risk while enabling innovation.

The United States, a traditional “swing state” in the matter of crypto’s political legitimacy, is taking the lead. By the end of July 2025, the White House has published a comprehensive roadmap to make the U.S. a global capital for crypto, effectively “ushering in the Golden Age of Crypto”. Making legitimacy more than an empty gesture, the initiative involves no more than a dozen pieces of concrete legislation designed to dispel numerous ambiguities that have persisted for so many years. Most prominently, the Presidential roadmap aims to grant the Commodity Futures Trading Commission clear jurisdiction over spot markets of most non-security digital assets. This is by far the largest remaining gap in crypto oversight. The report also promises more concrete guidance for tax planning associated with mining and staking and a clear understanding of how Anti-Money Laundering rules will apply to the DeFi and self-custody sectors. The current approach is now further fleshed out by a number of key pieces of legislation.

- The GENIUS Act, which passed into law in July 2025, is the first-ever federal regulatory framework for stablecoins. Recognizing USD-backed stablecoins as not a “new” threat, but a new form of basic payments infrastructure essential for retaining the dollar’s primacy on the global stage. It subjects issuers of USD-backed stablecoins to a strict federal regime, covering standards of reserve quality, audit requirements, accessible redemption.• New regulations surrounding surveillance: The administration has likewise taken an unequivocal position against a government digital currency with the Anti-CBDC Surveillance State Act which aims to prohibit a retail central bank digital currency permanently, due to deeply rooted privacy and civil liberties concerns.

The executive branch is also getting in on the action, as regulators are now being urged to undo the purported “Operation Choke Point 2.0” that cut off banking access to crypto firms. These frameworks will allow banks to offer services in custody, issuance of stablecoins and tokenization of assets, according to the new guidance. That is a huge change, from skepticism into a regulatory integration vision in which digital asset firms can have bank charters and clear rules on access to central bank master accounts. But this is not an U.S. specific trend. This pattern of establishing very structured, regulated markets is being replicated around the globe. Fully implemented over 2025 — the European Union’s Markets in Crypto-Assets Regulation (MiCA) imposed bank-grade governance, reserve and disclosure requirements on stablecoin issuers. In Asia, Hong Kong’s comprehensive Stablecoins Ordinance came into force on August 1, 2025, which requires any issuer intending to market to the public to be licensed from the Hong Kong Monetary Authority (HKMA) submitting it to set clear operational standards, including fully segregated reserves and one-day redemption times. However, the United Arab Emirates (via its increasingly overlapping VARA and ADGM regimes), Nigeria (via its 2025 ISA Act), and Turkey all fall on the opposite side of the fence but are not without their respective underbelly, establishing licensing regimes that can recognize digital assets but contain extensive AML/KYC and consumer protection requirements. The message is loud and clear: the days of grey area are gone. This availability transmits that for TRON specifically, virtually the whole TRON rails is carrying regulated assets between regulated endpoints.

TRON’s Centrality: Unseen Engine of Stablecoin

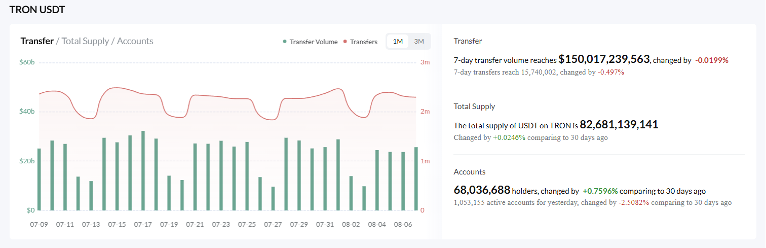

TRON has become a cash family member of systemically important digital assets in this new world Stablecoins are dubbed as the most widely adopted crypto product, and TRON consolidates the status of being the de facto network for USDT transfers and balances by the middle of 2025. In reports published in the first half of 2025 by independent observers, the USDT supply on the TRON network was estimated to be around US$81 billion, with TRON regularly placed in the top rankings of daily active addresses and global transaction throughput.However, the clear cut value proposition behind TRON was always its simple appeal of providing predictable low costs, fast settlement times, and an account-based model conducive to high-frequency payments and treasury management. This efficiency made it enormously geopolitically relevant. In providences facing currency fluctuation or capital measures, USDT on TRON acts as a low resistance, semi-dollar exchange system that enables billions of buck-denominated everyday borderless remittances and exchange settlement to function outside of correspondent banking. This ‘real-world’ utility, most recently, is exactly what places the network at the intersection of rival national policy priorities from financial integrity and (AML) to monetary sovereignty and sanctions enforcement. But there are challengers to this dominance. One of the most awaited structural shifts on the horizon is the “Plasma” chain as announced by Bitfinex and Tether. It is pitched as a zero fee network and even represents a piece of the stable-issuer strategy for USDT to internalize further parts of the value chain. Researchers remarked this makes TRON the network most at risk of displacement by a zero-fee, issuer-aligned chain, since most of TRON’s activity and TRX token destruction is fueled by USDT transfers. The end result will depend on how competitive Plasma can be in terms of liquidity, institutional confidence, and developer tooling against TRON’s significant headstart, but the strategic intent is clear — stablecoin issuers are making moves to embody the economics of usage, not just issuance. This drives TRON to always improve its value proposition ahead of being just a low-cost rail.

So far, we’ve covered the realities of your on-chain existence as it relates to how they are treated policy and cost wise by TRON. This is a consequence of the maturation of the crypto space, where policy is no longer a theoretical construct, but a real world operational reality implemented in constructor fashion on-chain. At the same time, TRON network — by its very design, sets the price of every transaction and de-facto cost that goes with it. For any business or individual utilizing TRON, these two layers (enforcement and cost) are crucial. And, as stablecoins have grown, they have ended up well within the policy blast radius. As we move through 2025 such will be characterized by two trends: precision of sanctions and public-private partnership for freezing the illicit assets. April 2025: U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned eight TRON addresses due to funding illicit financing networks. This move also highlighted the fact that stablecoins on public chains have become high-priority targets for sanctions playbooks. As a result, sanctions screening, counterparty diligence and fast incident response are becoming very basic prerequisites for any business leveraging TRON. This has been coupled with pre-emptive collaboration in this regard. An operational partnership between TRON, Tether, and TRM Labs called the “T3” triad launched in 2024 has shown that speed of analytics and close cooperation between issuers can actually have a material impact on criminal activity, with over $100M in assets frozen by mid-2025. This combination of neutrality at the base layer and enforcement at the application layer is rapidly establishing itself as the industry-standard model. On the one hand, in parallel with this enforcement reality, the network has a fundamentally different resource model. Using the transaction, each TRON consumes Bandwidth (for size of the data) and Energy (for computational power if it is a smart contract like ever TRC-20 USDT transfer). There are three methods through which users can obtain these resources: freezing TRX tokens to receive a daily quota, allowing the protocol to burn TRX in their name, or purchasing TRON energy from a third party. The measurement updates for 2025 assign a resource profile with around 345 Bandwidth for the most common transaction (a USDT payment) and one of two Energy levels:

- ~65000 Energy. A USDT transfer to recipient address that has received USDT previously. If you do recurring payments this will be your usual fee.• ~131,000 Energy. That’s how much you need to transfer USDT to someone else who has never used the USDT contract (for example, in case of outgoing transfer to a new recipient). Blockchain will have a one-time storage initialization cost for every piece of data; this is reflected in the increased cost.

Not having enough Energy to cover (or offset) that cost leads to the protocol burning TRX to pay for that cost, which is, at 2025 rates, up to 14–28 TRX per transfer, depending, again, on network congestion and resource prices. This has resulted in a detailed market for Energy, enabling users to obtain the resources they need at the cost of only 1/3 - 1/5 of the TRX otherwise burnt. This two-cost structure is important to understand in order to operate on TRON properly. The savings add up to be quite considerable for any business doing thousands of payouts.

Strategy, Tools and Cost Efficiencies in the New Normal

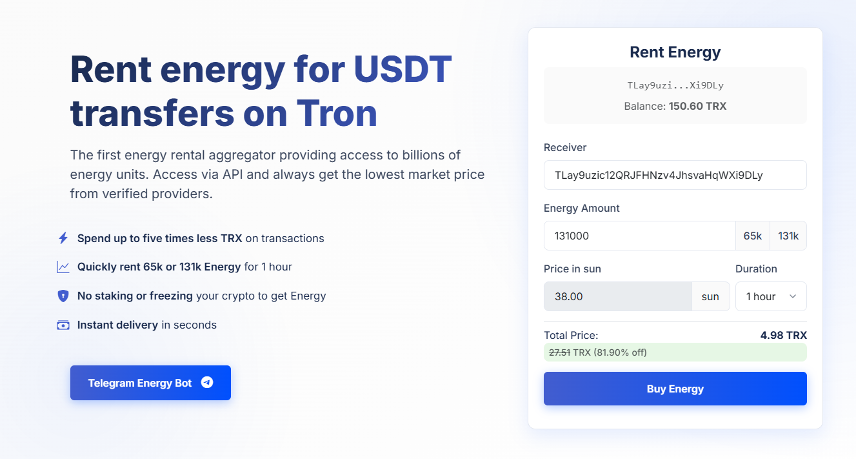

As global regulation converges with the economics of on-chain activity, strategy and executive function becomes a must-have for anyone transacting upon TRON. Well, success is no longer merely about technology- About equal vigor managing compliance and cost-channel. Compliance-wise, the road is mapped out. There is a requirement for businesses, exchanges, and wallet providers to include TRON addresses in existing sanctions screening and to ensure appropriate processes for complying with issuers and law enforcement freeze requests. Your licensing status has real implications on which stablecoins you can onboard users to in jurisdictions like the EU, Hong Kong, or the UAE, how you can market these products, and what disclosures you are required to make. This is now a requirement for access to the market, not an option. In terms of the cost management approach, the strategy is all about Energy. The costliest mode of operation is to burn the TRX with every transaction. Unsurprisingly, the quickest way to do this is to make sure you have enough Energy before making the transfers. This has given rise to a meta-industry of resource aggregators for frequent senders. Tron energy rental has transitioned from a specialized hack to a mainstream tactic. Tron energy rental services keep the per transaction costs of businesses and high volume users close to zero. Rather than locking up a massive amount of capital to freeze TRX, they can simply rent energy on the Tron blockchain whenever they need it, for an amount they can even afford to pay. It retains capital and offers predictability in expenses.

A number of providers have appeared for anyone interested in these sorts of services. One example is netts.io, which markets itself as an Energy rental aggregator. Provides on-demand Energy delegation using a user-friendly UI, an API, and Telegram bot for auto replenishment. This is designed for high-frequency senders (e.g. mass payouts, exchanges withdrawing for user withdrawals) who do not want to stake and lock their own capital and would like to optimize costs. Such platforms expose an Energy on a programmatic basis and at low cost, just in time, you can provision it in your application. This signifies that developers will be able to embed Energy provisioning directly into their applications, allowing for a seamless user experience without requiring end-users to have an understanding of the TRON resource model. Before integrating with any third-party service, users should do their own due diligence on pricing, stability, and security.

The Final Word: Finding a Balance Between Code and Law

This core value prop is what has made TRON an essential platform of globally important financial infrastructure; TRON as a stablecoin rail; fast, cheap, scalable. This has done also, it become a public policy tool. The network has an original Energy and Bandwidth model as an economic driver, but this can only be realized with the implementation of intelligent resource management strategies such as just-in-time (JIT) delegation of Energy. Globally, political realities have changed rewarding players who are open but responsible. Such as solutions wherein protocols scale efficiently yet retain censorship resistant nature at the base layer; issuers being transparent, proof of reserves, and collaboration of freezing any illicit fund; and platforms meeting the high bar of license, AML and disclosure across jurisdiction layers. This hybrid model, envisioned in 2025, is not hypothetical; it is what the bulk of stablecoin activity around the world operates on. The ultimate question is whether the competitive pressures exerted by new networks like Plasma pull activity away from TRON for good, or whether they merely keep the TRON horse galloping that much faster to the finish line: stablecoins are now being regarded as basic payments infrastructure. The jurisdictions that achieve alignment between consumer protection, AML, and innovation will capture a greater share of the value of these rails. The bottom line for TRON users, developers, and businesses is simply this: Budget your Energy, budget your compliance, and get ready for a reality where stablecoin issuers, exchanges, and the regulators are more often than not sharing the same loop — and often in real time. It is at this code-law intersection where the future of digital assets will be forged and it is this new reality that TRON remains at the very heart of. But the signals to spot over the next few months will be significant. Will MiCA in Europe bullseye euro stablecoins down to a binary of full compliance versus offshore dollar-denominated versions, or will global issuers converge around a single, high bar? The degree of professionalism and the pace with which licensed entities in Hong Kong establish a dynamic, compliant local market, and whether this market becomes intertwined with the digital currency trials ongoing in mainland China. And in the US will the new clarity lead to institutional and innovative adoption distributing crypto to its rightful place as a US superpower? The answers to these questions will be the context for the next chapter not just for TRON, but for the entire digital asset ecosystem. Read more about where the story of TRON goes from here.