More than 15 years have gone by since the enigmatic Satoshi Nakamoto first mined the genesis block of Bitcoin and the paradoxical world of cryptocurrency remains quintessentially opaque. On the one hand, it is the miracle of technology, a multi-trillion dollar asset class that has already captivated investors, developers and futurists around the world. In contrast, ask somebody on the street if they have ever paid for a cup of coffee in cryptocurrency and the answer will likely be an emphatic no — this divide between its financial valuation and its real world use-case is the defining battle of our time for digital assets.

So why is mass adoption such a distant dream? It is not just one obstacle standing in the way, but rather a tangled web of technical challenges, deeply-entrenched psychological barriers and the subtle, yet impactful, hand of social inertia.

Newcomers Gauntlet: Ten Thousand Harrowing Missteps

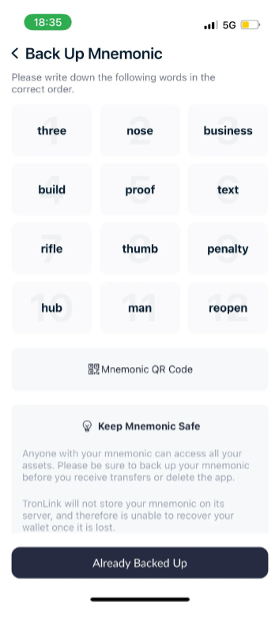

For non-crypto people this first step inside the bubble can feel like getting ready for a high-risk trip into an unknown jungle. This is akin to opening a modern bank account, a procedure that requires only a few swipes of your smartphone and a quick picture of your passport; it usually takes several minutes. For the time being, think about establishing a non-custodial crypto wallet. Right out of the gate, they are inundated in strange ideas, public keys, private keys and the holy "seed phrase," that 12 or 24 word list of random words that is the master key to all their virtual coffers.

This is why they are warned: "You are writing this down. Store it somewhere safe. Never share it. If you lose it your money is lost forever." It does not have a 'forgot password' link. Who you can call if something goes wrong, and there is no customer support to call. For your average civilian, used to the safety nets of traditional finance, having one single point of failure is a chilling thought.

Writing a description is both a heavy burden and merciless. But this is not just a technological hurdle, it is a psychological one — it shifts the entire responsibility of security onto the user, which hardly anyone is trained or gets ready to deal with. You had to choose the type of wallet you wanted to set up—hardware, software, browser extensions, mobile — each with their own trade-offs of security, making a more technically complex process even more convoluted.

Intricacies of the Blockchain Engine

And even if the user makes it through the onboarding process, the technology that powers much of crypto is in many ways its own source of frustration.

- Small, Product-Market Fit with Fees Not Really Free. The common ledger functionality of Bitcoin and Ethereum were a game changer but they weren't built for high-speed worldwide commerce on the first place. They are only able to handle a limited amount of transactions per second, compared to Visa network level. In those moments of high demand (thanks to a hot new NFT collection or some speculative wave hitting the market), the network gets clogged. This leads to a bidding war for block space, effectively blasting transaction fees from a few dollars to hundreds. Not to mention this fee volatility, which makes the utility of these networks for small, everyday payments out of the question. This has given rise to layer-two scaling solutions to solve this, from ATM style rolls upwards, but they split liquidity between chains, introducing new trust assumptions and leading to ATM users stuck in a vortex of confusion, away from the elegant single experience.

- Lengthy Confirmation Times. We live in days of instant satisfaction, and the thought of having to wait to have a transaction "confirmed" upon the blockchain seems very old-fashioned. Reaching finality for a payment could take minutes, or hours depending on how congested a network is. Not good enough for POS transactions where speed is necessary.

- Not User Private Enough. Most of the blockchains are radically transparent Addresses are pseudonymous, not anonymous. Transactions are public — a record of every transaction is visible on the public ledger that is accessible by the masses. With one link between a real-world person and their crypto address, their entire financial history is out in the open. Furthermore, both individuals and businesses that wish to maintain a degree of privacy over their finances are rightly concerned over this lack of privacy.

Wall of Mistrust: Landslide & Bad Associations of Inertia

Perhaps the greater barrier, outside of the technical problems, is the psychological one: inertia of the known. Whether they accept it or not, the existing financial system, for all its faults, is good enough for most people. We trust banks, we know how credit cards work, and we have baked-in regulations and consumer protections created over the course of centuries. Cryptocurrency demands that we throw away this system and put our faith in an unregulated and de-centralized computer code. It's a paradigm shift that clashes squarely with the "if it ain't broke, don't fix it" mentality.

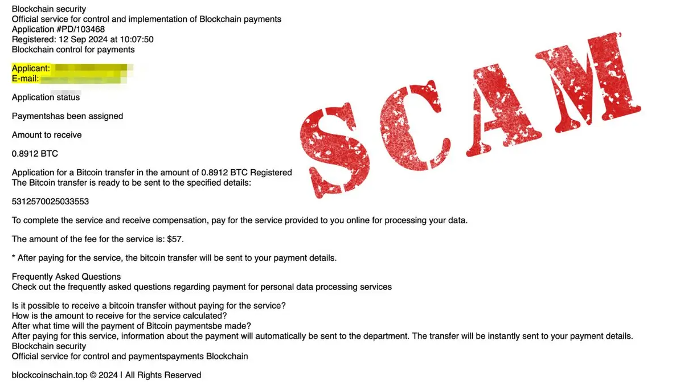

Crypto's image problems further exacerbate this natural resistance. From scams to hacks to the underworld, headlines have been plagued with it for years. While billions in user funds have been blown away in high-profile collapses such as that of the FTX exchange or the Terra/Luna ecosystem, the crypto meme of it being a lawless risk-filled "Wild West" filled with it's a still strong. Now include the "get-rich-quick" speculation, the extreme market volatility, and the environmental concerns about proof-of-work mining, and you have a veritable perfect storm of associations that collectively form an impenetrable wall of suspicion.

Breaking the Glass: Paving the Path Forward from Barriers to Opportunities

However, the story of cryptocurrency is one of a never-ending evolution. Currently though the industry is trying to help with these issues directly, there is a greater emphasis on making a more inclusive ecosystem.

- Innovative Technology is leading the way. Some newer blockchains are being developed right from the start with scalability and low fees in mind. Account abstraction is the new concept and will most likely eliminate the seed phrase nightmare and allow us to have social recovery, spending limits and eventually the user-friendliness of a normal bank account.

- However, most importantly is the awareness that adoption is going to be about more than just technical superiority, but ultimately empathy for the end-user. Emerging are applications, capable of abstracting blockchain complexities and furnishing them with a seamless, intuitive skin, that will appear natural to a layman.

This user-centric innovation is exemplified in the Tron ecosystem. The combination of high throughput and ultra-cheap transactions for a long time has made the Tron network a leading platform for USDT stablecoin transfers. But in order to do this, users need "Energy", a unique network resource. Energy was obtained by having the user freeze his/her own TRX tokens, a rather inconvenient and capital-driven process. Another friction point for new users, this as well was acceptable to more experienced users.

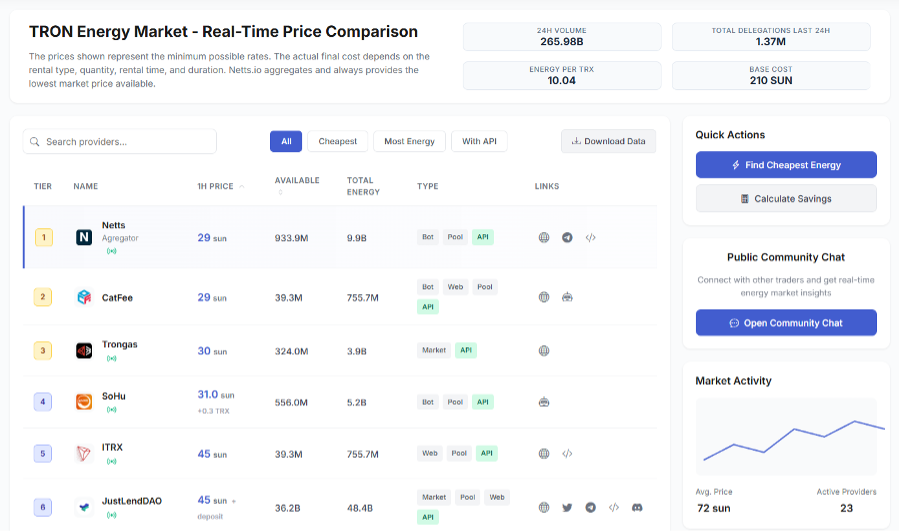

And this is exactly where the Tron Energy Market has birthed a new paradigm bursting with life. As an alternative to locking their own capital, users can now use the Tron energy rental service. This enables them to lease the required Energy for a certain period, against a fraction of TRX fee. It dramatically reduces the threshold to join and allows a much more effective use of the network.

Leading this charge is netts.io — the energy rental aggregator that made Tron Energy renting ridiculously easy. It is an aggregator platform that combines offers from several providers to guarantee that users always get the best price available in the market. With the clean web interface or an embedded Telegram bot, a user can now rent the 65,000 or 131,000 Energy required for USDT transfers in less than a minute, spending a small fraction as compared to burning TRX for the same transaction. Netts.io offers businesses API access and tools to facilitate automated management.

It is not only making the life of the individual crypto holder easier — it is building the infrastructure for businesses to be able to smoothly integrate these efficient payment rails into their business. Great case study in the sense of zeroing in on a user pain point and creating a simple but well working solution that makes the whole ecosystem easier to use.

The way to mass acceptance is not a sprint; it's a marathon. It's about repeatedly, systematically getting better at the user experience, building a more reliable and scalable infrastructure, and undoing some of the reputational damage that has been done over the past decade. When people talk about the future of crypto, they need to get headed into one direction of replacing the traditional financial system. While most see crypto as a side-by-side aspect, it is intended to eradicate the traditional system.

We truly believe that we are simply building a parallel financial system that will eventually outcompete the traditional one by being faster, more efficient and more transparent. As more and more services like netts.io remove barriers altogether and make the complex but often invisible systems behind it, a reality. The great divide between traditional money and crypto money is getting ever smaller, and the future of a decentralized financial system is finally nearing.

Although many planters have been able to gain mass attention, they have been able to do so through ludicrous stories and promoted "use-cases". It has been a long path, but it's one with stability. No longer it won't be one that will rely heavily on superficial promotions. There's still much room for growth, but the roots have solidified and the options for change are here. Similar to more opportunities being provided to retail users, the financial scene is expanding, and the most noteworthy shifts ahead will be the availability of cryptocurrencies and blockchain, whether that is through earning, borrowing, saving or investing.