Year 2025 marks an intriguing moment for the global financial system, one existing between a financial paradigm that is centuries old, and a digitally-native frontier, that is now shifting into its next evolutionary stage. Of course, there is the legacy financial system: the sprawling, complex, and oldest institutions, the world of banks, clearinghouses, and payment processors of the past generations. On the other hand, we have blockchain networks such as TRON, for which a new set of rails are being laid that operate on a completely different set of principles — globally available, always on, native digital. But comparing these two worlds is not just an exercise in technicality, but a window into the possible future of how we transport and store value that juxtaposes a model of institutional trust versus a model of cryptographic trust.

OLD WAY: An Analog System in a Digital World

The traditional financial system is a wonder of institutional trust and legacy infrastructure. When an individual or company wishes to transfer money, particularly one that crosses national lines, a much more tortuous process is set in motion than a single click conjures. The old way is characterized by a number of broad, but generally limiting, features.

In a system that is a hierarchy of intermediaries. International wire transfers are complex and do not go from one account to the next — a small business owner in Chicago wiring a payment to a supplier in Berlin cannot simply pay them in one fell swoop. It jumps from local bank to a larger correspondent bank, probably through a network such as SWIFT, then to another correspondent bank in Europe, and finally to the recipients bank. Every single one of these institutions is a trusted intermediary, confirming the transaction, taking your piece, passing along. This custody chain is useful as the top two banks do not have a direct relationship. As a result, you have an opaque process; good luck figuring out where a payment is at any given time, and you can forget about knowing exactly when it will arrive. This opacity creates great anxiety and operational inefficiency as companies must deploy resources to track payments and reconcile accounts.

This dependence on third parties and their processes creates extensive backlogs. This is because the traditional financial system is almost exclusively restricted to working days, working hours, and a pre-internet economic landscape. If you initiated a transfer on a Friday afternoon in the US, it may not start its international journey until Monday morning in Europe, and may take 3 to 5 more business days to be received into the recipient's account. This timing from the analog era is a huge source of friction in our 24/7 global economy. It can push longer timelines for supply chains, slow commerce, and create uncertainty in cash flow for businesses. That could translate to days of agonized delay with real-world damage for anyone sending critical remittances to relatives for essential necessities.

In addition, costs can be high and are by no means completely transparent. For example, a standard international wire transfer may carry a flat fee of $25 to $50, but the actual hidden costs are in the loss of value due to commissions on currency exchange rates. Banks usually incorporate a large spread — 2–4% being common—into their rates for foreign exchange, a hidden cost which is rarely made fully visible to the consumer upfront. The costs imposed by the various intermediaries stack on top of one another to create a system that is both bloated and costly, with end-users frequently hit much harder than even they understand. These high fixed costs prevent small-value cross-border payments from being economically viable, hindering the expansion of the global creator and gig economies.

Lastly — the biggest problem — accessibility. Around the world billions of individuals are unbanked and underbanked — they simply do not possess the official documents, credit history or geographical location to secure access to these services. The control is also completely centralized: accounts have more strings to be frozen, transactions blocked or reversed by institutions with basically total discretion, and customers are left with no resources and no leverage over their own financial lives.

NEW WAY: TRON's Digital-First Approach

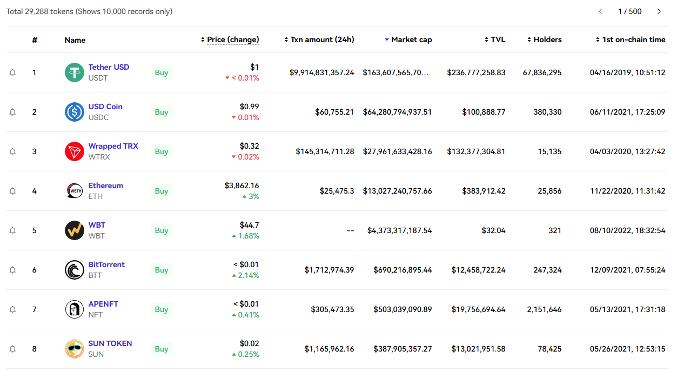

New approach is worlds away from the fundamental architecture of value transfer that blockchain networks as we can see in TRON's case. Its "new way" is ground-up re-thought for the digital age around disintermediation and programmability. Just like any other stablecoin pegged to the US dollar, when the user sends USDT on the TRON network, this transaction itself sends directly from the user wallet to the recipient wallet in a peer-to-peer fashion. Through the decentralized global network of nodes, the transaction is validated using cryptographic proof, and an immutable update to the public ledger created.

This architecture enables near-instant settlement. Transactions are confirmed in seconds, not days and are not reversible. It runs 24 hours a day, 365 days a year, rain or shine, on a holiday, a weekend, or whatever the time zone. For a firm, this translates to immediate settlement of cross-border invoices, greatly enhancing cash flow and mitigating counterparty risk. For a person, this means sending remittance to family half a world away on a Sunday evening knowing that he or she will receive it in seconds not days. These low, predictable transaction costs also enable new business models altogether, like micropayments, where content creators are paid fractions of a cent in the moment as their work is consumed.

Its knack for accessibility may be its most impressive trait. Even without centralized authority, any person in the world with an internet connection and smartphone can via downloading a wallet up, generating an address and transacting instantaneously. This makes financial services available to billions of people that have either none or very limited access to the conventional financial system. The user has total control, possesses their private keys, and can experience genuine asset self-custody. This marks a new paradigm of the ideal or being a customer of a bank to the sovereign with respect to one own funds. Not only can you program with the assets themselves. They're not just money on TRON; one can imagine them embedding money into a smart contract and then automating an escrow, a lending protocol, or anything else without an institution in the middle to plug into computer code.

The TRON network is not free of its own systems of costs, of course. It works on a special model of resources called Energy and Bandwidth. Each transaction spends some of these resources — especially Energy for smart contract executions, such as a USDT transfer, among others. For more novice users, that can be a little misleading. The cost is not a simple, albeit high, bank fee, but rather a cost for the on-demand consumption of the network's computation. This is a learning curve in many ways, compared to this model that is direct and transparent by nature. Historically, users have needed to purchase and stake TRX, the network's native token, in order to obtain the Energy required, a process that is both cumbersome and steeply capital-intensive. Which is what held many back from this new way feeling as natural and frictionless as the old way has been this usability hurdle.

Closing the Convenience Gap: Maturation of the Ecosystem

Whenever a new technology is launched, there is always a gap between its raw capability and user-friendliness. Back in the early days of the internet, it requires a lot of technical command lines and understanding of protocols; but now we have intuitive apps that abstract all of that out. The same and most important evolution is now occurring on the TRON Network. This is being covered in the form of a new sophisticated layer of services that hides the initial complexity of its resource model to make the network much easier and cheaper for anyone to access.

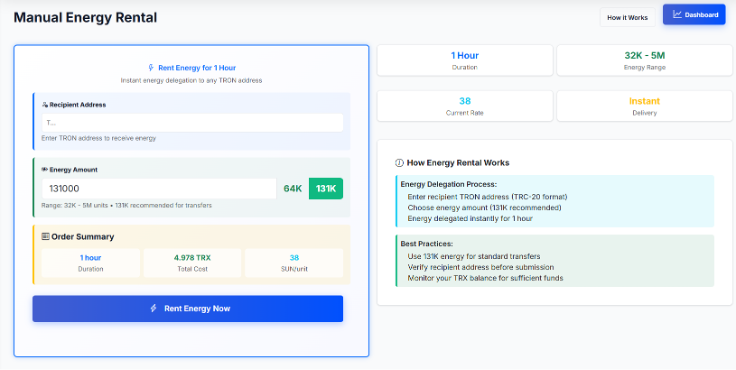

This has lead to creation of a whole new market to provide direct solution for the Energy problem. Advanced platforms have even begun to provide for Tron energy rental, meaning users can have full access to make the Energy necessary for their transactions when needed. Rather than requiring a large, long-term capital outlay to stake TRX, customers can now go to a platform and rent energy on the Tron blockchain for a finite period — an hour, a day, whatever they need — for a fraction of the cost of burning their own TRX for the same transaction.

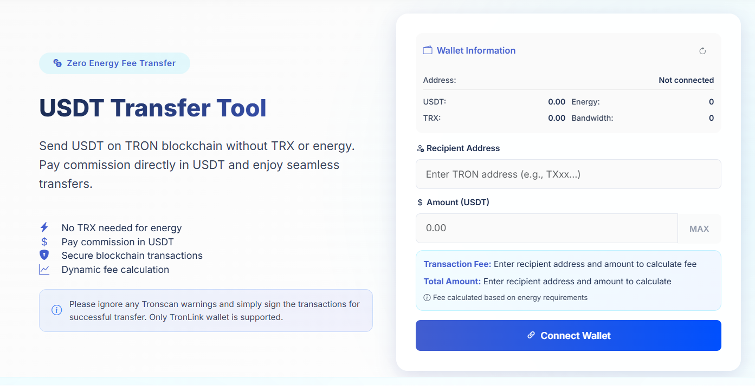

They act as a utility layer for the Tron network as a whole while also establishing a two-sided market between the lessor and the lessee. Tron Generators aggregate Energy from large-scale TRX stakers (who are passively earning yield on their assets) and offer these to regular users in a simple UI. This innovation per se greatly decreases the entry bar and cut transaction cost at least by 80% or even higher than the default solution to burn TRX. It turns this complex resource management problem into a simple utility model where users pay only for the compute, storage, and network they use on a pay-as-you-go basis. Many of these service platforms have even gone as far as to automate the entire process of rental and transaction as one single process flow. Users can pay transaction fees directly in the asset they are sending (e.g, USDT), thus never needing to purchase or hold a separate gas token (e.g, TRX).

This final layer of abstraction, however, makes the comparison to the traditional banking system incredibly salient. All at once, the "new way" becomes faster, cheaper, easier to access—and then, also, just as easy, if not easier, yet. Gone are the days of needing to understand forks, layer two scaling solutions, and permissionlessness before you could send a penny. Now, a user can send a global payment from their mobile in seconds, for a known $1–2 fee. Signaling a system that is fast trending towards the functionality of the best contemporary finance apps, while running on the genuinely global, open, and decentralized rails of a public blockchain, providing an early insight into a more efficient and equal future of money for everyone.

In netts.io, we are pooling energy from thousands of providers creates a competitive market where a user can perform a Tron energy rental at the lowest possible price, and this transforms a complex requirement on the network into an easily accessible and cheap utility. A service layer is a vital bridge between the raw power of the TRON network and an audience far larger than ever before, affiliated or otherwise.

Netts.io's USDT Transfer Tool is for those who do not want to interact with the energy market - it completely eliminates the user interaction. Through bundling the energy delegation and transaction all with one user flow and paying the fee directly in USDT, we achieve a simplicity that directly competes for and arguably wins over modern banking apps. And that is where the "new way" becomes also very powerful. Another user has no need to know how energy or bandwidth functions (just as a banking customer has no need to know the SWIFT messaging protocol!) All they do is connect their wallet, sign a transaction and the value moves nearly instantly and at low cost. This final touch of user-centric design is what pulls it all together, allowing a powerful yet complex blockchain to become a truly usable global financial rail.