In the summer of 2025, the cryptocurrency market has once again demonstrated its ability to change. Last month's numbers were massive; Bitcoin broke records and pulled the entire market along to make ad a whopping $4 trillion in valuation. Yet even before August has come into focus, a new storyline is taking shape. The ruler of crypto is pausing for breath and the attention of investors is drawn to altcoins not just because Tether keeps printing new $USDTs but some of them – as TRON, 15th by market capitalization as per Coinmarketcap at press time (approximately $1,3 bln) – have been showing unanticipated strength and there are certain traits in each one that grants it with a unique potential.

The move of Bitcoin over $123,000 in the middle of July 2025 was not just another crazy bubble. This rally was anchored by a significant institutional buzz and changing regulatory dynamics in the United States. Spot Bitcoin ETF did the same for institutional capital. There are 2 primary funds to keep an eye on; BlackRock's IBIT and Fidelitys FBTC, which have been absorbing more BTC that being mined with classic supply squeeze dynamics. That left these ETFs with a record $158 billion in assets under management after receiving an all-time high of $1.18 billion in inflows on a single day in mid-July. Fund flows in 2025 alone have soaked up over $52 billion in net inflows, which has effectively changed the market structure and been a significant validation of Bitcoin as "digital gold" for institutional portfolios.

And the flames were stoked further during Crypto Week in Washington D.C., which saw several legislative developments related to crypto on Capitol Hill. The time in between — July 18th to be precise — was a regulatory desert for stablecoins until the GENIUS Act finally got inked. The CLARITY Act, which wishes to set Bitcoin and Ethereum as commodities regulated by CFTC. In summary, this de-risking of the crypto space has given a green light to wall street and corporate treasuries on the sidelines. The U.S. Securities and Exchange Commission (SEC) just announced "Project Crypto," an apparent effort to update securities laws for the digital era, too.

SEC Chair Paul Atkins set a clear objective: "[…] that innovative companies will not be driven offshore by burdensome regulations," suggesting an increased open-mindedness from the regulatory bodies.

Much of that momentum, however, has cooled down now in the beginning of August. The bitcoin pullback from all-time highs came as no surprise to many, with some indicating a correction was due and profit-taking so close to its rapid rise. The market is currently waiting around these key support levels with most traders looking at it as a period of consolidation before the next leg higher. Even with the pullback, bullish sentiment is still very high as certain analysts have year-end price targets north of $250k a piece — like Fundstrat's Tom Lee.

The Altcoin Awakening: Not Just a Sideshow

However, even as Bitcoin was dominating the market buzz, there was a tidal wave that had been building underneath the surface in the altcoin space, one driven by decentralized finance (DeFi) and Non-Fungible Tokens (NFTs). Now, facing possible demise, capital rotates into other promising projects as an alt-season could emerge with dominance from Bitcoin.

The second largest cryptocurrency Ethereum has hence been one of the biggest beneficiaries. The DeFi ecosystem, speculation over the Pectra upgrade slashing gas fees, and unveiling of spot ETFs have help push avalanche up 50% or more in the past month. The surge in these ETFs was met with continuous inflows which is an indication of a systematic flow rotation from Bitcoin to Ethereum by institutional players. Looking ahead, Ethereum is on an ambitious trajectory with upgrades planned for Surge and Verge which will likely allow the network to process more than 100,000 transactions per second—efforts that if proven out would represent a strong claim as a foundational settlement layer within the decentralized web.

Solana has equally been a star performer. Developers and users are flocking to the network's high-speed, low-cost network which remains a home for flourishing ecosystems of decentralized applications (DApps) and non-fungible tokens (NFTs). A Solana staking ETF was recently launched which will only help in legitimizing it further to large institutional investors. Technically, Solana has been working on a bullish "cup-and-handle" pattern and may rally to $250-$300 depending on how key resistance levels are crossed.

The Ripple Effect: XRP Reawakens

Yet, one of the top altcoins having a strong market cap and resistance is XRP. This move reflects renewed confidence in the company after suffering years of regulatory uncertainty stateside and with a series of favourable court-rulings, as well as being bundled into the U.S. strategic crypto reserve, it looks much more capable.

This means that XRP, year to the year, has soared more than 380%. Powered by a network and operate daily for sending large bills to other side of border. The real-world use-case of XRP is much stronger compared to most other tokens that are supposed to do nothing but get more investment from institutions.

TRON: Slowly Emerging but Efficiently Growing

Against the tide of broader market trends, TRON (TRX) has been making its own way. While it may not generate the same hoopla as some of its peers, its mojo is working and it deserves to be on your radar for what's next. Over the last few weeks, TRX has been a standout in a period of large-scale correction, as it has decoupled rather significantly from Bitcoin and performed well in comparison to most other major cryptocurrencies.

TRON is popular in part due to its high-speed quality. The network is famous for its high throughput and low transaction fees, which makes it highly demanded to its stablecoin transfers and dApp usage. Since transaction costs remain a headache for users of any crypto assets, most hope to save more with other solutions.

For those who interact with the TRON network frequently, it also has become common to rent Tron Energy in lieu of burning TRX. This has helped in the expansion of Tron Energy rental services which offers a low-cost means for contributing to actions on the network. With the increase in growth of the network, these are likely to be vital assets within the TRON ecosystem.

The TRON community is however taking steps to make the network as better. One relevant recent development is a topic around suiting the SELFDESTRUCT opcode to handle Ethereum's EIP-6780. While this sounds technical, it is actually very significant when it comes to security and the future of development on the network. The upgrade changes the deletion mechanisms for smart contracts and, as a result, eliminates possible attack vectors and improves the stability of the network. If this upgrade goes ahead TRON will consequently operational Energy cost to 5000 Energy fee, making sure TRON follows Ethereum its own security enhancements well in the future.

New Tools in The TRON Ecosystem

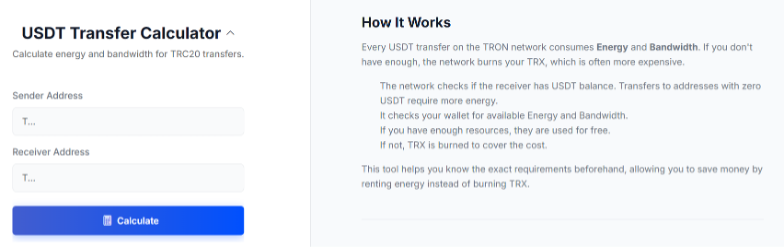

The TRON ecosystem is maturing and with that comes more tools for users. The recently released USDT transfer converter from netts.io makes for an excellent example. This announcement fixes a common pain point for TRON users: the fluctuating cost of USDT transactions.

It uses the sender's Energy and Bandwidth for free transactions, while it also takes into consideration if the receiver up to now has a balance higher than 0 USDT. This is important because transfers to wallets that do not already contain USDT require twice the amount of Energy, a fact many users are still unaware. Before sending them, a user can visually see their exact resource requirements by utilizing the converter. So, deciding to rent Energy for a couple of TRX instead of having the network spend many more TRX to cover the cost is another step toward reducing costs on the network.

A brief primer on how the hypothetical savings would look:

Method | Receiver Has USDT | Receiver Has no USDT

--- | --- | ---

Burning TRX (Default) | 13.84 TRX | 27.70 TRX

Paying for Energy — to rent more Energy | 2–3 TRX | 4–5 TRX

Savings | 80+% | 80+%

Developers and high volume users can use netts.io in a programmatic way to get the transaction costs for whatever you need them.

A Shifting Global Landscape

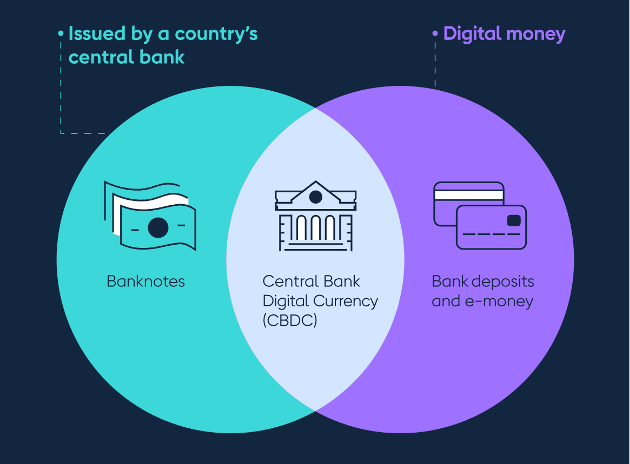

The change winds are not blowing only in the US. The European Central Bank (ECB) has stated intentions for an October 2025 launch of their Central Bank Digital Currency (CBDC). Even though the outcome of a digital Euro is an ongoing debate, the mere announcement led to sharp rises in Bitcoin and Ethereum. This assures the entire crypto sector that central banks are putting in enough consideration into digital currencies which will naturally speed up change providing a major boost to mainstream legitimacy.

What Lies Ahead

While we are beginning the latter half of 2025, the crypto market finds itself at least an apparent fork in the road. Can Bitcoin rise and conquer its previous highs? Or will the attention stay on altcoins, with Ethereum, Solana and TRON at the forefront?

(These questions are likely to be answered differently in different places for a few reasons.) The course of monetary policy among the Federal Reserve, further investor inflow into crypto ETFs by institutions, and blurring regulatory rubber lines will be pivotal in determining where cryptos go from here. No doubt there are plenty of known unknowns ahead, such as the potential for sentiment to turn (causing an exodus from ETFs) or miners to dump their Bitcoin if prices drift too low.

But so are the opportunities. Over the past few weeks, it seems like some of the biggest steps towards making this new period not just a time to get by but perhaps to thrive have all come together at once for what could potentially be the most fun and transformative era in games. In 2025, the cryptocurrency market is more mature and integrated with the traditional financial system than ever before. It is a time for both investors and enthusiasts to stay tuned, spend wisely and keep up with the noise on this space. Crypto 2.0 is only in its infancy as the next chapter in the crypto saga is written.