The cryptocurrency stage is an intriguing new land, a computerized wild west guaranteeing decentralized opportunity and unmatched monetary action. A world of possibility, of new societies born through the deep-seated shared faith in a new methodology of trade. However, as with every new frontier, it has a seedy underbelly. Beneath the halo of the computer screen and the endless scrolling of market charts, lies a shadow world of crime, a world that has become increasingly organized, increasingly bold and eventually increasingly violent year after year.

This isn't about hoovered code, or disappearing crypto coins. They are cautionary tales about human greed, human ingenuity, and, more and more, human brutality. They show how high the stakes are in a multi-trillion dollar ecosystem, and test the fabric of a world with no single, central authority on security – which is entirely up to them as individuals to hold up. Below are some of the most notorious crypto crime stories from the past five years: ghost heists that eluded authorities for years and violent crimes that took the battle off-screen. The ripples of these events have been felt to the tune of billions of dollars in losses, and our very understanding of risk in the digital age.

Ghost Heist: $14.5 Billion of LuBian that Vanished

Last week an audacious $3.6 billion cryptocurrency heist − the biggest in history − remained a secret for nearly five years. This was not a ghost story that hackers whisper about in the far corners of the internet, nor some fable that the gods of crypto had spread amongst the elders of yore. It was a simple, unadorned fact so brutal that the entire world simply ignored it. LuBian — a large Chinese Bitcoin mining pool that once had as much as 6% of the global Bitcoin hashrate back in 2020 — was the victim. The prize was 127,426 Bitcoin. The take was worth an incredible $3.5 billion at the time of the December, 28, 2020 theft. That value has grown to over $14.5B by the time the world heard of it in August of 2025.

Finally brought to light by the painstaking analysis work of blockchain analytics firm Arkham Intelligence, the story of the LuBian heist shows the devastating potential of a single small vulnerability. Such event did not spin out into a major public announcement, or an all-hands on deck attempt to address it on social media, or a panic on the markets. LuBian was a big coin on the Bitcoin network, and the next day, 90% of its assets disappeared in the digital ether.

It wasn't some futuristic, mind-altering, brute force attack method. It was an almost textbook example of a primitive form of cryptographic assault: a brute-force attack. According to Arkham's investigation, LuBian have generated its private keys using a bad algo. The one, albeit gargantuan mistake poured a hole into their digital vault. This weakness enabled the attackers to enumerate the private key, which is to say try every key on the digital keyring until they found the one that unlocked the hoard. When they were in, they siphoned through over 90% of LuBian Bitcoin reserves in one seamless transaction. Another smaller transaction then drained BTC and USDT from a related Omni Layer address. This means that the attack was highly skilled and planned with accuracy and swiftness.

Incredible as the crime was, what ensued was almost as incredible. Once they comprehended just how monumental of a breach this had become in scale, LuBian simply did not surface. So, they attempted to negotiate with the thieves — in the only way which they were able to — on the blockchain itself. They bombarded the hackers wallets with a batch of 1,516 minuscule Bitcoin transactions. There were embedded messages in these transactions which were stored permanently on the blockchain with the OP_RETURN method. Some of those messages asked for the assets to be given back, and even offered a reward. It was little more than a last-ditch, digital message in a bottle, a silent appeal to phantoms who had already fled. The hackers, naturally, never replied.

The stolen fortune — larger than the Mt. Gox and Bitfinex heists combined — lay dormant for years. Kept locked in the digital vault like a giant dragon asleep, its value would swell with the Bitcoin tide. This accumulation formed the largest anonymous whale wallet in history, a wealth seat that could impact markets if sold ever. Then the silence was broken in July, 2024, when the funds were detected being aggregated in a large lump by Arkham analysts — the first signs of life from the thieves. However, even when the heist unraveled in 2025, the Bitcoin market remained surprisingly stable, reflecting perhaps the markets maturation or a paralysis to news of large-scale theft. When the flying ghost of LuBian combines with a session of cybercrime textbook-level scaremongering galore, the world will respond: a cybercrime story with the potential for chills that illustrates just how many of the biggest threats can materialize years into the future where few eyes can see them.

Bybit Hack: Exchange Under Siege with $1.5 Billion

The LuBian heist was an assault on the operational security of just one organization, but another class of crime goes for the platforms where millions of users actually trade. Even with all the resources and security teams available at the largest centralized exchanges, they are still a honey pot for sophisticated attackers. For example, the Bybit hack of 2025. The exchange that had lost $1.5 billion in total became one of the leading derivatives trading platforms, which is considered a heavy loss. Though granular details of the breach remain tightly held, it is understood to be an "access control attack," where the hackers would have been able to break into an organization via weaknesses in admin credentials or internal infrastructure.

Such attacks are devastating, not just in terms of the financial loss, but also because they ultimately undermine the trust which is a critical part of the ecosystem. People trust these platforms with their assets assuming they are walled fortresses of security. Outbreak of the four walls is panic-inducing throughout the broader market. This showcases one of the main paradoxes of crypto: the end-user typically seeks out the fastest, easiest onboarding processes potentially from an exchange, which in itself becomes the sexiest target for any criminal.

Ledger: When It Hits Too Close to Home

Until now the perils of crypto were more or not less viewed unidimensionally through a financial and digital lens. The worst that was a battered wallet, not a body. However, recent developments have turned that notion on its head; a disturbing new trend has emerged: violent, physical crimes against cryptocurrency entrepreneurs and investors. But it turns out life and limb are now on the line in the crypto space, as kidnappings, assaults and extortions have become the brutal new normal. The M.O. is often disturbingly identical: stalking the affluent, violent siezure and the employ of mutilation as a terror tactic to ensuade compliance and hasten the ransom payment. Not only a tendency towards imitative crimes, but also the growth of blackhats gangs organized on the basis of crypto-extortion — the pattern in which this is realised points to that.

In 2025, two cases from France sent shockwaves through the European crypto community, exposing this new horrific trend.

Ledger Co-Founder

In January 2025, David Balland, a co-founder of the high-profile crypto wallet firm Ledger, was seized with his spouse from their house in main France. The purpose of the assailants, was transparent: a crypto ransom. And to show how serious they were and to make the greatest psychological impact, they did something so horrendous. The kidnappers severed one of Balland's fingers and sent the severed digit, along with a ransom demand, to his business partner, Eric Larchevêque. The incident left deep scars in the community but the couple was later freed by police.

Entrepreneur's Father

Just some months later, the horror was forcibly repeated. In May 2025, four masked men abducted the father of another crypto entrepreneur from a Paris street and bundled him into a van. In a suburban Airbnb, he was held hostage for two days. The kidnappers called his son, sent him a video of his father, who had also lost a finger, in the same gruesome state and demanded millions in euros. French police managed to storm the premises and free her, arresting five suspects.

These kidnappings form a pattern that is deeply distressing and runs throughout Europe. Section of her home in Belgium where her husband, crypto investor Stéphane Winkel, was kidnapped in December 2024. Marzena M. was reported missing on Tuesday, September 26 and was not found until Wednesday afternoon (September 27). We can only guess what kind of long-term psychological damage these events are inflicting on the closely-knit crypto community. It has necessitated a hard appraisal of the challenges that lie within the realm of real-world OPSEC. Indeed, high-profile founders and investors understood: they no longer just need to protect their private keys, but also their very bodies.

Safe Haven: Conducting Secure, Affordable Transactions Using Market Aggregators

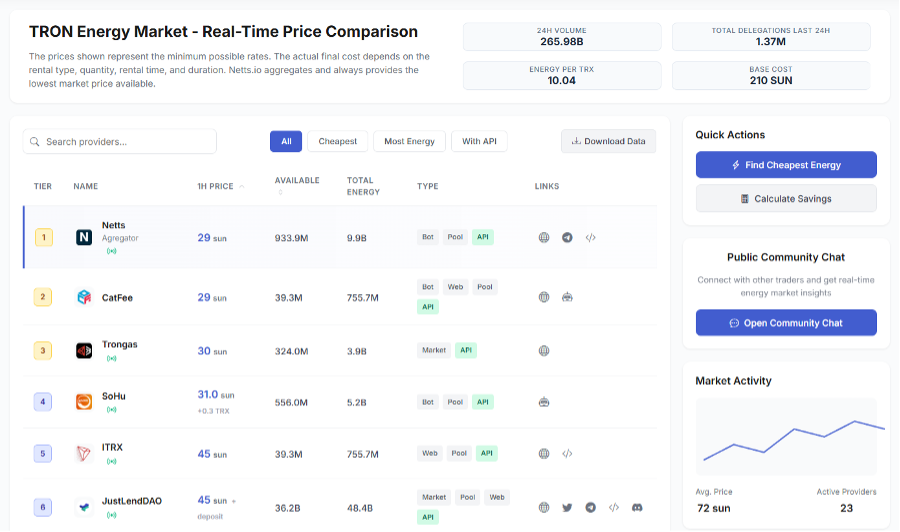

The idea of renting TRON Energy opened a new market to millions of users with hundreds of providers. This is all great for prices, but it poses an additional challenge: who is your ally? How do you discover the best price without spending hour after hour comparing various platforms? There's a genuine possibility of finding yourself at an unauthorised site or, at minimum, where you spend more.

Modern market aggregators tackle this problem. A platform like the Netts.io serves as a live, all-encompassing interface for the TRON energy marketplace, with data sourced from 20+ of the best providers. And very importantly completely safe websites, which strips away the largest layer of risk for the user.

This is a robust set of benefits associated with using an aggregator like Netts.io TRON Energy Market:

- Simplicity in sacrifices. It has crystal clear unambiguous apples-to-apples price comparison You can immediately view the rates payable from the primary suppliers, like feee.io, TronSave, CatFee, Trongas, SoHu, JustLendDAO and other.

- Advanced Filtering. You can sort and filter providers based on what you need. Get the Lowest Rate, find the one that has the Most Energy for your big volume needs, or choose a With API that allows for easy integration into your dApp or trading bot.

- Make Data Driven Decisions. Where before procuring energy was an educated guess, this level of transparency turns acquiring energy into a no brainer, since it is based fully on data. You see the average price across the market (about 72 SUN), daily delegation volume (more than 1.35 million), and total energy volume (over 265 Billion) metrics, giving you the whole market trend at a glance.

This means not only enormous cost savings, but also protecting yourself from fraudulent providers, overpricing and uninterrupted service by means of a trusted aggregator. It turns the transaction cost management process into something more professional.

Conclusion: Empowerment through Knowledge

There will always be shadows in the world of cryptocurrency, as the promise of its vast riches will always draw the greedy, the violent and the fraudulent. The LuBian heist and the bloody abductions in France are pretty much reminders of this risks. However, they must not dictate the future. The crypto ecosystem is maturing. As new threats arise, so too do new defenses the community creates for them. That evolution between having coins in a wallet and having the resources by making the effort in using something like TRON Energy is proof of this increased sophistication. Learn the risks, implement the security best practices and take advantage of new power tools. The frontier remains untamed, but it is yours to traverse in safety, in success — with the right roadmap.